Due to demographic changes, the demand for senior-friendly housing in the USA and Europe is rising rapidly. This opens up attractive investment opportunities for investors – with unexpectedly high returns.

A report by a research institute recently alarmed the public: The country’s older generation was facing a housing crisis with a shortage of millions of apartments suitable for seniors.

But demographic change is increasingly affecting the housing market not only in Europe but also in the U.S. «The senior housing segment is expected to remain strong in the coming decades,» according to worldwide real estate consulting firm JLL, commenting on the U.S. market.

Demand for senior housing or «senior living,» as the segment is known in the U.S., is driven by demographic change. At the epicenter are the baby boomers, people born between 1946 and 1964, who are already retired or will leave their careers in the coming years.

Rising Life Expectancy

Real estate consulting firm CBRE reports that there will be 88 million people over the age of 65 living in America in 2050, almost twice as many as today.

Another factor is rising life expectancy: Estimates indicate that nearly one-fourth of Americans who are 65 years old today will reach their 90th birthdays; one in ten could live to at least 95.

Different Preferences

This new generation of seniors has different preferences than its predecessors. «Baby boomers are looking for living spaces that meet their health needs, but that offer a high quality of living as well,» says Thomas H. Lee, Chief Medical Officer at health care consulting firm Press Ganey Associates. «They will vote with their feet and move to locations that meet their requirements,» he adds.

These locations are also characterized by their proximity to established infrastructure. «Seniors prefer urban neighborhoods with a high quality of life where they can reach amenities on foot,» describes the U.S. news portal Curbed. Access to suitable services is also important.

Property That Meets Requirements

«Since the number of households with members over 80 is growing, it is critically important to strengthen links between residential areas, health care facilities, and other services,» emphasizes Jennifer Molinsky, primary author of a study published by Harvard’s Joint Center for Housing Studies entitled «Housing America’s Older Adults 2018.»

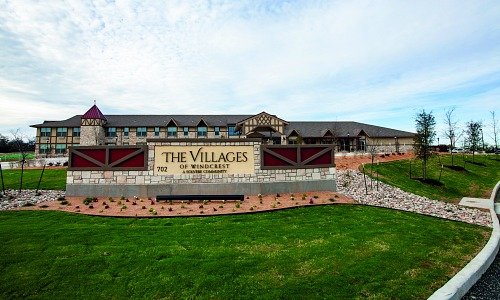

An example of a property that meets these requirements is the Villages of Windcrest, which opened in early 2019. This project by Zurich-based ACRON is a two-story, 84-unit residential complex for self-pay residents in Fredericksburg, Texas.

Fundamental Trend

The fact that ACRON was able to successfully place the Villages of Windcrest with investors underscores not only the quality of the property but also a fundamental trend: Senior living is a segment highly regarded by investors.

According to the most recent statistics available from consulting firm CBRE, revenue generated from senior housing complexes in the second quarter of 2018 grew by 27.3 percent over the prior-year period. Among the investors are private as well as institutional investors and REITs, says CBRE.

Attractive Returns

These investors can feel validated by the positive data in this real estate market segment. Rents recently increased 2.5 percent year over year, and JLL analysts are firmly convinced this upward trend will continue. Returns are attractive as well: According to the Property Index of the National Council of Real Estate Investment Fiduciaries (NCREIF), senior housing most recently produced an annual return of 11.6 percent, whereas the average return for all major real estate categories was 7.2 percent.

It’s no wonder, therefore, that the «Emerging Trends in Real Estate 2018» report issued by audit firm PwC contends that residential real estate for seniors will outperform all other segments of the residential real estate market in terms of investment outlook.

Strong Potential

Rental apartment complexes at the high end of the market have particularly strong potential. This is attributable to two factors, as determined by consulting firm Marcus & Millichap in a recent research report. For one, the rate of home ownership among older Americans is decreasing, so logically, demand for rentals is rising. Secondly, the experts at Marcus & Millichap see a «rapid increase in wealth among older families.»

According to the study, people over 75 have median assets of $264,800 – more money than any other age group. In second place on the wealth scale are 65- to 74-year-olds.

Many seniors also have a very particular preference: They want to live near the universities they once attended. «One of the smartest decisions developers of senior housing can make is to form a strong relationship with a university,» states a report published by information portal Senior Housing News.

- An example of such a facility is the next project of the ACRON Group: Under the name «Oklahoma University Senior Living», the company is realizing a facility with 188 residential units in Norman, Oklahoma. It is located in the immediate vicinity of the University of Oklahoma campus and will be part of a new development with a large multi-purpose arena, a 225-room hotel, offices, 283 single-family homes, many restaurants, and entertainment facilities. The ACRON Group is preparing further residences - the demand of American senior citizens for them is definitely there.