Artificial intelligence has opened up a new era. AI is not a fleeting fad but one of the greatest technological, economic and social revolutions in human history.

Rolando Grandi, CFA, Fund Manager for Echiquier Artificial Intelligence, La Financière de l’Echiquier (LFDE)

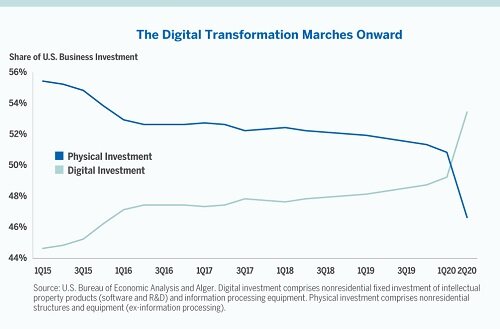

While its role has been highlighted by the crisis triggered by the Covid-19 pandemic, which accelerated the digital transformation of businesses, today AI is a mature technology that will impact all sectors of the economy and all businesses irrespective of their size.

The purpose of LFDE’s dedicated AI fund, Echiquier Artificial Intelligence1, is to benefit from the exponential growth of AI by selecting companies from around the world that are developing or adopting this universal technology. Explore this visionary fund, launched in June 2018 in France.

AI is a Conviction

Today AI has all the foundations it needs to thrive: a virtually endless amount of data, Big Data, the cloud and artificial neural networks.

With the cloud, today AI is able to deliver solutions to all sectors, thanks to the progress achieved in building infrastructure and increasing computing capacity.

A Comprehensive And Disciplined Approach

Unlike other funds dedicated to AI, Echiquier Artificial Intelligence is not strictly limited to tech stocks. The fund invests in AI in a holistic manner wherever sources of innovation are identified. Its approach is very specific. As global as it is cross-cutting, it makes it possible to invest anywhere in the world, in all sectors and in companies of all sizes.

The fund uses semantic algorithms to create an investment universe of around 150 international companies whose market capitalization exceeds one billion euros. The management team then targets four types of businesses: those that develop AI solutions, those that adopt them, those that create physical or digital infrastructure and those that facilitate AI by endowing it with senses and a brain.

Promising Companies

This proprietary classification of companies makes it possible to precisely identify the players in this technological revolution.

The qualitative investment process allows for the selection of the most promising companies in terms of future growth, strategic leadership and technological innovation. A very strict valuation methodology then allows for building and managing positions in a conviction portfolio.

Large Variety

The fund is invested in thirty or so international companies with potential for substantial appreciation in the stock market, with very few GAFAM investments, and stands out because of its sector and geographical diversity. Currently, it has US stocks such as ALTERYX2, Chinese stocks such as PING AN HEALTHCARE TECHNOLOGY or PINDUODUO, a specialist in e-commerce, and Latin American stocks such as MERCADOLIBRE, a specialist in e-commerce that provides its users with online payment tools.

Its cross-business sector variety is reflected in its exposure to the entire AI ecosystem, from telemedicine to industry and including insurance, cybersecurity and the cloud. Another distinguishing feature is that the fund’s stocks are covered by an analysis of Environmental, Social and Governance (ESG)3 criteria using LFDE’s proprietary methodology.

Yielding Results

The fund recorded performance of +78.93 percent in 2020, vs. +6.33 percent for its benchmark index, the MSCI World Net Total Return, and +120.1 percent since its creation (+25.3 percent for the index).4

The growth opportunities are staggering: according to PwC’s estimate, AI is expected to contribute more than Dollar 15 trillion to the global economy between now and the end of the decade.

1 This SICAV sub-fund is mainly exposed to the risk of loss of capital and equity and currency risks.

2 The stocks referred to are given by way of example. There is no guarantee they will remain in the portfolio over time.

3 Environmental, Social and Governance analysis is not the same thing as a constraint on selectivity.

4 Figures as of 29 January 2021. Past performance is not an indication of future performance.