It’s been a challenging year for investors amidst the drop across all asset classes with nowhere to hide. We believe the correlation between equities and bonds will remain high, ushering a new regime of investing and redefining the way investors should approach portfolio allocation and management.

By Naji Nehme, CFA, Chief Investment Officer, Petiole Asset Management

Gradual fall in US inflation and sustained rise in rates by the Federal Reserve (the Fed) set the tone for the next chapter in the global economy. After reaching a 40-year high in June, inflation is starting to ease but remains elevated (rising 7.7 percent year-on-year in October), which led the Fed to embark on one of the steepest monetary tightening in history. Although their policy is showing initial signs of positive effect, the Fed is expected to keep raising rates through 2023, with a forecast of 5.00 - 5.25 percent by May 2023 and staying elevated for a longer period.

The consensus view is that inflation will go back to 2 percent by 2024. We find this assumption unrealistic, and while we do expect long-term inflation to moderate, we think it would remain above 2 percent for a longer time, principally driven by food inflation, wage and shelter inflation.

Shelter CPI, which accounts for a third of US Headline CPI, rose 3.18 percent YoY and 0.8 percent MoM - the largest monthly gain in 32 years. Coupled with ca. 2.4 million shortages in US real estate, we find it difficult for this inflation to moderate.

Wage inflation will also stay high driven by talent shortage. The top five globally in-demand roles would be in sectors:

a) IT/Data

b) Sales & Marketing

c) Operations and Logistics

d) Manufacturing & Production

e) Customer-Facing and Front Office.

Average wage growth YoY went up from 2.05 percent pre-COVID to 4.7 percent post-COVID, and this is a concern in view of growing labor shortage. According to a Korn Ferry study, more than 85 million jobs may go unfilled by 2030 because there are not enough qualified people to occupy them, and the Total Global Labor Deficit as a percentage of the workforce is set to increase over the year, reaching 6 percent by 2025 and 11 percent by 2030 compared to 3 percent in 2020.

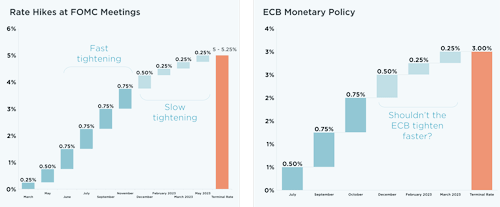

Source: Goldman Sachs, Reuters (click graphic for large view)

Starting with 25bps in March, the Fed has since then increased to 50bps in May then consistently further increased by 75bps with each FOMC meeting through November. We expect that the tightening measures will remain but at a slower pace through 2023. In fact, in December, we have seen the Fed increase rates by 50bps and commit to their Fed rate hike policy. Europe is at a higher risk than the US as inflation remain high (close to 10 percent), yet the ECB has been engaged in a slower tightening strategy with a terminal rate expectation close to 3 percent.

The combination of lower inflation and higher rates has been directionally positive for risk assets, and private markets outperformed public markets historically. Moreover, with high inflation persisting longer, a correlation between equities and bonds will remain high, driving investors to consider diversifying the public markets’ risk.

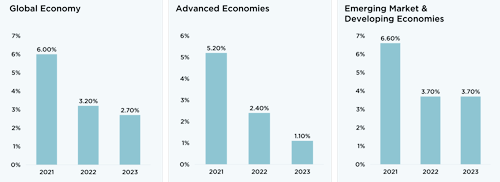

Source: The IMF outlook update October 2022 (click graphic for large view)

Can the Consumer Drive the US Economy to a Soft Landing?

GDP growth estimates are lower. Sustained inflation and the Ukraine-Russia conflict have reduced estimated global economic growth from 6.0 percent in 2021 to 3.2 percent in 2022, and 2.7 percent in 2023. This is the lowest growth trajectory since 2001 excluding the global financial crisis and the COVID-19 pandemic, and the slowdown is experienced in both services and manufacturing.

However, when we look at consumer behavior, they continue to spend. US consumer spending on e-commerce is expected to hit a record $1 trillion in 2022. A shift has been seen in the second half of the year where consumers shifted from durables to services. In November, consumers spent a record $9.12bn in online shopping during Black Friday, a 2.3 percent total increase compared to a year earlier with electronics being the major contributor. In addition, US Cyber Monday online sales reached $11.3 billion, the most ever for that day and a 5.8% increase compared to 2021.

While US household debt as a percentage of GDP is at 73.7 percent in Q2 2022 (well below the 100 percent level experienced before the Great Financial Crisis), US personal savings dropped to pre-pandemic levels with US consumers’ increased adoption of «buy now, pay later» payments and preference to private label brands.

Although US consumers seem in good shape today, we expect further signs of fatigue and lower spending going into 2023, which should impact earnings.

We are Witnessing a Cyclical Bear Market

Based on GS definition, cyclical bear markets are typically prompted by rising interest rates, an impending recession and falling earnings – factors which we currently face.

It would be highly challenging to engineer a soft landing, and while a recession is inevitable, we view it as mild compared to other historical recessions. In fact, credit conditions and market liquidity remain healthy. Debt maturity walls extend beyond 2024, which also brings less stress on refinancing balance sheets.

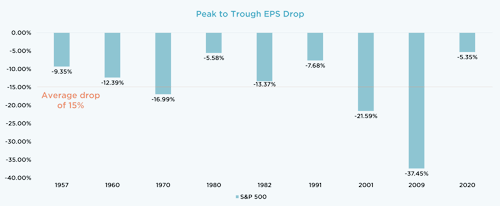

Source: Bloomberg (click graphic for large view)

Valuations have moderated nearly to median levels historically. There’s more room to adjust, however, led by the high rates environment and earnings downgrades. In periods of high rates, the S&P 500 traded historically in the range of 16x to 17x P/E, yet we are still close to 20x today. In past recessionary periods, earnings fell by 15 percent but current expectations are still pointing to +5 percent growth in EPS.

To conclude, a new and complex investment regime is emerging that will demand investors to find new ways of investing in quality assets while maintaining an enhanced degree of diversification.

Key Takeaways:

- US inflation will moderate but remain at a high level

- Continued tightening will remain but at a slower pace in the US

- Mild recession in the US and a deeper recession in Europe

- US consumers are still healthy

- P/E multiples have de-rated considerably

- We expect US earnings to drop by 5-10%, lower than historical recessions

- The correlation will remain high between bonds and equities

- There are ample investment opportunities with good downside protection and high upside convexity

Portfolio Implications

We outlined a three-phase approach to our investment strategy, with the first phase beginning in the second half of 2022, i.e. Overweight Credit and Underweight Equities. As we look into 2023, we will carefully shift our Underweight Equities position to more Neutral position.

With the IPO market being shut down, private companies unwilling to raise capital through down rounds would need to turn to alternative financing. We forecast many of them would opt for debt, to which Petiole is prepared to serve with venture and growth debt solutions.

After paying low single-digits for a long time, yields are picking up and opening attractive opportunities where corporate debt pays mid-double-digit today compared to low single-digit a year ago. In addition, structured credit such as CLO debt and equity offer attractive yields for longer-term investors. Petiole will take advantage of the rising yield environment by investing across the yield spectrum and offer a diversified income portfolio.

Private equity vintage years post-recession achieved higher than average returns. Thus, we will increase our exposure to private equity while keeping a defensive underwriting, and favoring companies with strong balance sheets, low leverage and sustainable growth margins.

In summary, with elevated inflation and higher correlation between public equity and fixed income, investors can benefit from what could be an attractive cycle for private markets and take advantage of Petiole's expertise to diversify their portfolio.

Naji Nehme, CFA

Naji Nehme, CFA

Chief Investment Officer, Petiole Asset Management

Petiole Asset Management is a Swiss-based boutique asset manager with $2.1 billion assets under management with headquarters in Zurich. Finma-licensed and regulated to conduct business in Switzerland, the USA, Hong Kong, and the Cayman Islands, Petiole has established solid working relationships with leading global sponsors through successful direct and co-investments over nearly two decades. Visit petiole.com to know more about Petiole Asset Management investment solutions and services.

This article has been prepared solely for information and advertising purposes and does not constitute a solicitation, offer or recommendation to engage in financial services of any kind.