Recent surveys have hinted at a slowdown in economic growth, but underlying inflation is proving more persistent, pressuring central banks to hike rates further. Yet, how tightening credit conditions interact with already restrictive monetary policy stances is a key uncertainty.

In early 2023, economic growth has been more resilient than feared due to the boosting impact of the Chinese reopening, combined with a warmer winter that supported the construction sector and prevented an energy crisis in Europe.

What’s more, several governments – especially in Europe – acted swiftly to extend support to households, which helped cushion the effects of high inflation on their income. However, these factors are temporary, and recent soft data indicate a possible turnaround.

Aggressive Measures to Support the Economy

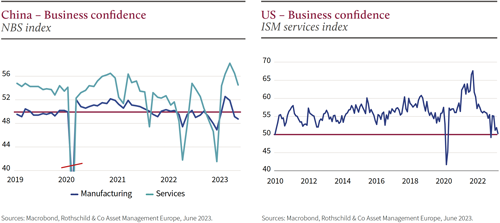

In China, April’s industrial production and retail sales missed expectations, and May’s business confidence surveys have also disappointed, suggesting the reopening bounce is indeed fading. The manufacturing PMI unexpectedly fell to 48.81, the lowest reading since December 2022, and the non-manufacturing index (services and construction sectors) slid to 54.5 from 56.4, also below expectations.

Investors have trimmed their 2023 growth forecasts to 5.5 percent from almost 6 percent earlier this year, but more downgrades might be needed as it remains higher than the government’s target of around 5 percent, while officials seem reluctant to take aggressive measures to support the economy. Ironically, although China’s GDP and profits could disappoint investors, a more moderate growth profile is likely good news for the global economy as the fight against inflation is far from over.

(Click graphic to enlarge)

In the US, the outlook is murky. On the one hand, surveys have deteriorated. The ISM manufacturing index fell to 46.9 in May, thus remaining in contraction territory for the ninth month in a row, with the new orders sub-index falling to a depressed (42.6) level. In the services sector, business confidence fell to 50.32, a level seen lower only once since early 2010, barring the fall in 2020 in the midst of the pandemic, pointing to a clear economic slowdown.

On the other hand, the labor market remains very tight. Vacancies unexpectedly surged in April to 10.1 million, and the ratio of openings to unemployed people rose to 1.8, the highest in three months and near an all-time high. Furthermore, 339,000 jobs were created in May and the three-month average moved up to more than 280,000, suggesting labor demand remains robust. In contrast, wage growth is still incompatible with a swift return of inflation to the Fed’s target.

Inflation Eased More Than Anticipated

Business confidence has also weakened in the Eurozone, especially in the industrial sector, and recent revisions showed that Germany fell into a technical recession earlier this year. On the bright side, inflation eased more than anticipated in May according to flash estimates, falling from 7.0 percent to 6.1 percent on lower oil and gas prices.

Core inflation fell from 5.6 percent in April to 5.3 percent as service inflation eased 0.2ppt to 5.0 percent, the first deceleration since last November as the 49 Euro regional public transport ticket in Germany played an important role. Yet, while the momentum on core inflation is easing, service inflation should remain elevated over the course of the summer, and possibly even go back on the rise.

Sources

1National Bureau of Statistics, 2023

2Bureau of Labor Statistics, 2023