The food industry in the GCC is witnessing a rise in the demand for new dining concepts and diverse cuisines, due to changing consumer preferences and increasing health awareness.

Demand for food in the GCC is expected to be driven by improving macroeconomic factors, rising population, buoyancy in tourism, and various initiatives being taken by the governments to improve self-reliance. According to a new report published by Dubai-based Alpen Capital, the industry is witnessing a rise in demand for new dining concepts and diverse cuisines due to changing consumer preferences and increasing health awareness.

Please click here to view the report.

The food services sector continues to evolve at a significant pace to cater to the needs of the consumers and hence, remains one of the most promising sectors driving food consumption in the region. Despite the volatility, the food sector has remained relatively resilient opening opportunities for scalable and accelerated growth. Inorganic growth strategies are likely to continue as companies look to capitalize on the burgeoning food demand in the GCC.

Industry Outlook

According to Alpen Capital, food consumption in the GCC is projected to grow at a CAGR of 2.8 percent to reach 56.2 million MT by 2027 from an estimated 49.0 million MT in 2022.

The country-wise food consumption share in the GCC is projected to change marginally through 2027. While Saudi Arabia will continue to remain the largest GCC market in terms of food consumption, its share is likely to fall from an estimated 57.1 percent in 2022 to 55.5 percent in 2027.

Highest Growth

Bahrain is expected to witness the highest CAGR at 4.5 percent. In contrast, UAE and Saudi Arabia are expected to grow at moderate paces of 3.3 percent and 2.2 percent, respectively, largely in line with their population growth.

The report states that the growth among different food categories will range between 2.0 percent and 3.2 percent from 2022-2027. The vegetable food category is projected to secure the highest CAGR at 3.2 percent, closely followed by ‘others’ and meat at 3.1 percent each.

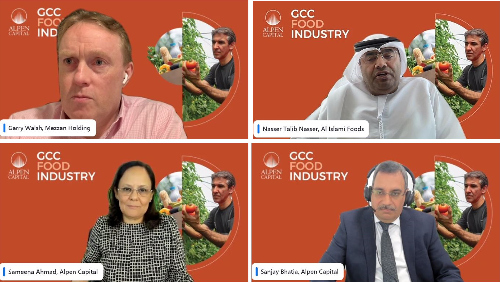

Watch the Panel Discussion

The report was launched over a webinar followed by a panel discussion featuring Garrett Walsh, CEO, Mezzan Holding, Nasser Talib Nasser, CEO, Al Islami Foods and Sanjay Bhatia, Managing Director, Alpen Capital. Sameena Ahmad, Managing Director, Alpen Capital moderated the discussion.

- To view the recording of the webinar click here.

Alpen Capital is a leading investment banking advisory firm that offers a full range of advisory services in M&A, Debt, Equity, and Capital markets. With local know-how and regional expertise, Alpen Capital has executed transactions for some of the largest business conglomerates in the GCC, South Asia, Levant, and Africa. Alpen Capital also publishes industry research reports on various sectors in the GCC. It has offices in Dubai, Abu Dhabi, Doha, Muscat, and Mumbai.