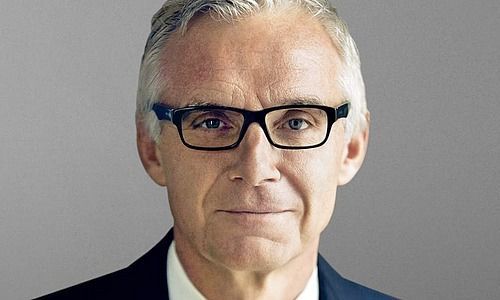

An influential Swiss pension fund advisor wants Credit Suisse chairman Urs Rohner removed. The shareholder advisor is hoping for prominent support.

If Urs Rohner had his druthers, he would stay on as chairman of Credit Suisse until the Swiss bank's turnaround concludes in 2018. Those plans may change: another proxy advisor has joined the opposition to the lawyer's reelection to the board, which he has presided since 2011, at an April 28 investor meeting.

Vincent Kaufmann didn't mince his words: Rohner is the «wrong man» to lead the bank into a new era, the head of Geneva-based shareholder rights group Ethos Fund told «Aargauer Zeitung» in an interview.

Murky Strategy

Credit Suisse's share price has halved, thousands of jobs have been slashed and the bank has paid billions in fines and penalties over missteps and wrong-doing under Rohner's auspices, Kaufmann said.

«Today, no clear strategy can be distinguished. It's just cutting more jobs,» the Ethos director said.

The fund urged its clients last week to oppose Credit Suisse's board of several items, including the dividend, executive pay, and a legal release for the board – a quirk of corporate Switzerland. Specifically, Ethos doesn't want the reelection of Rohner or Richard Thornburgh, a former CSFB investment banker who is now one of two vice-chairs of the Swiss bank's board.

Mobilizing Investors

Ethos isn't the only shareholder representative demanding radical changes at Credit Suisse: the far weightier U.S.-based group Glass Lewis is also telling its clients vote against the bank's board.

Glass Lewis wants shareholders to reject Andreas Koopmann, Iris Bohnet and Kai Nargolwala, who run Credit Suisse's compensation committee.

While opposition to pay and other hot-button issues isn't new, the dynamic will change if shareholders manage to mount a three-pronged opposition, along with U.S.-based Institutional Shareholder Services. Hugely influential, ISS can be expected to mobilize roughly 20 percent of investors, while Glass Lewis can deliver another 10 percent.

Taken together, ISS, Glass Lewis and Switzerland's Ethos pose a credible threat to any Swiss board.

No surprise then that Kaufmann is hoping ISS, which hasn't yet revealed its recommendations, will pitch in. The largest shareholder advisor in the U.S. has already told investors to vote down Novartis' pay scheme.

«We feel there is less to criticize in the Novartis annual report than that of Credit Suisse. It should be a suspense-filled AGM,» Kaufmann said.

New Chairperson?

Ethos has already mapped out the post-Rohner era, proposing Alexandre Zeller or Andreas Gottschling as possible replacements. Both are acquainted with the bank, and both are being proposed by the bank as new board members. Zeller most recently chaired stock exchange operator SIX's board, while Gottschling is a risk specialist and former consultant. Kaufmann emphasized that it is up to Credit Suisse, and not shareholders, to organize a succession plan.

Rohner has said little save for a curious interview with Swiss weekly «Weltwoche,» which did more to fan the flames of the opposition than quell the dissent. Meanwhile, Credit Suisse is approaching a perfect storm, as finews.com reported last week: tax disputes across Europe have reawakened, daily business is increasingly tough, and the bank still has a painfully large capital gap.

The Swiss bank reports the first quarter on April 26, two days before what promises to be a fiesty shareholder's meeting.