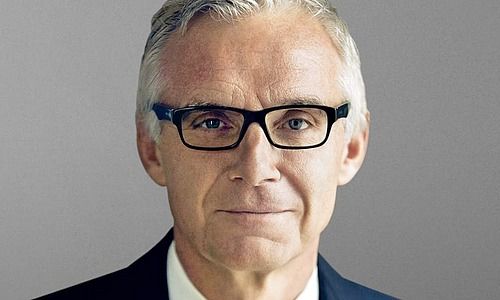

Wages paid in the banking industry may have come down since the financial crisis, but the total wage bill of his bank remained too high in relation to overall spending, according to Credit Suisse Chairman Urs Rohner.

The level of basic salaries and bonuses awarded to the CEO, management and chairman of Credit Suisse (CS) in 2016 was met with widespread criticism last week.

With yet another billion-franc loss and sweeping cuts in 2016, the increases awarded to both Tidjane Thiam and Urs Rohner don’t seem justified.

Lower, But Still High

The chairman – not surprisingly – offers another interpretation. In an interview with «Weltwoche» magazine (in German, behind paywall) he says that wages in the financial market traditionally were high.

But, more significantly, today’s top salaries are way lower than the ones paid before the financial crisis. Still, Rohner concedes, the total wage costs are too high in relation to the overall spending of the banks.

Starting From a Low Level

Rohner’s remuneration in 2016 rose by a quarter to almost 4 million Swiss francs. Faced with the huge loss of 2.7 billion francs, Rohner said he accepted to «voluntarily» forego half of the chairman’s fee of 1.5 million francs. He avoided speaking about a possible link between his remuneration and performance beyond stating that there was a connection between wage, performance and demand.

«Which is why we had to adjust wages selectively starting from a low level,» Rohner said. The chairman of Switzerland’s second-biggest bank in 2015 earned 3.2 million francs and was one of the world’s best-paid chairman.

Depressing Reading

Rohner also said that the damage to the reputation of banks was a serious issue and reading studies about the lack of trust in the banks by the general public made for depressing reading.

«If you speak to an individual client, it becomes clear that most of them are very satisfied with the performance of their bank,» Rohner added. The trust awarded in the performance of CS was also to be measured by the amount of new money the bank attracted, totaling about 250 billion francs since 2008.

IPO: No Need to Hurry

Rohner also responded to questions regarding the possible initial public offering of the Swiss business of CS. He said that the plan had been developed at a time, when the investigation into the mortgage-backed securities business in the U.S. had been pending and the bank hadn’t known how much cash it needed to settle the case. The bank has to fork out as much as $5.3 billion.

Based on what the bank knows about the costs to settle the claim, it will be able to re-evaluate the cased for a partial IPO, establishing the best way forward for shareholders and the company, Rohner said. The board will have the final say.

While Thiam earlier this week told «Bloomberg» that the markets wanted an answer about CS’ plans, Rohner sees no need to hurry: «We are not under a particular time pressure.»