Press «play» to listen to this content

1x

Playback Speed- 0.5

- 0.6

- 0.7

- 0.8

- 0.9

- 1

- 1.1

- 1.2

- 1.3

- 1.5

- 2

ex-cs trader receives investment boost for fintech. success for an ex-credit suisse trader and his fintech startup: investors have shown their faith in his company and provided him with ample liquidity to continue his work. another reason why established banks should watch out. revolut, the fintech company founded by nikolay storonsky, has received $66 million from investors including index ventures, balderton capital and ribbit capital to expand his business, «bloomberg» reported today. storonsky aims to open new offices in north america and asia and to expand the product portfolio of revolut. clients of the london-based company will be able to hold crypto currencies at revolut. and as early as next week, they will be able to exchange, buy or sell and transfer currencies such as bitcoin, litecoin and ethereum without having to pay a fee. revolut is generating revenue by profiting from the price differences between buyers and sellers. star guest at zurich conference. storonsky, 32, founded revolut two years ago with vlad yatsenko, a developer at deutsche bank. revolut is making money with an application that also contains a prepaid credit card and which the transfer of cash and exchange of currencies without charging fees. the company also provides consumer credit. apart from having worked for credit suisse, storonsky also shot to fame in switzerland, when he presented his fintech at this year’s «finance 2.0» fintech conference in zurich. rapid growth. revolut has had very rapid growth since its foundation and today employs a workforce of 140 people, in offices in london, krakow and moscow. with the money from the investors, storonsky plans to open new branches in new york and singapore, hiring an additional 20 people, «bloomberg» reported. «these are big markets, there’s huge demand for our products,» he said. «we’ve got waiting lists and now’s the time to enter.». the «slow» big banks. in the interview with «bloomberg», storonsky also offered his blunt opinion about the established banking industry. the banks were eagerly watching the fintech industry’s new products to see what they would want to offer clients in the future. «but they’re very slow,» he said. storonsky strongly believes that offering clients the chance to own and use cryptocurrencies is big step forward for the financial market. but the established big banks definitely aren’t there yet.

Ex-CS Trader Receives Investment Boost for Fintech

Success for an ex-Credit Suisse trader and his fintech startup: investors have shown their faith in his company and provided him with ample liquidity to continue his work. Another reason why established banks should watch out.

Revolut, the fintech company founded by Nikolay Storonsky, has received $66 million from investors including Index Ventures, Balderton Capital and Ribbit Capital to expand his business, «Bloomberg» reported today.

Storonsky aims to open new offices in North America and Asia and to expand the product portfolio of Revolut.

Clients of the London-based company will be able to hold crypto currencies at Revolut. And as early as next week, they will be able to exchange, buy or sell and transfer currencies such as bitcoin, Litecoin and Ethereum without having to pay a fee. Revolut is generating revenue by profiting from the price differences between buyers and sellers.

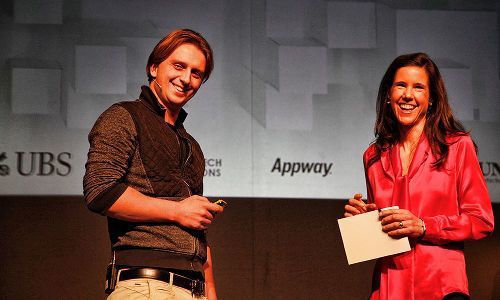

Star Guest at Zurich Conference

Storonsky, 32, founded Revolut two years ago with Vlad Yatsenko, a developer at Deutsche Bank. Revolut is making money with an application that also contains a prepaid credit card and which the transfer of cash and exchange of currencies without charging fees. The company also provides consumer credit.

Apart from having worked for Credit Suisse, Storonsky also shot to fame in Switzerland, when he presented his fintech at this year’s «Finance 2.0» fintech conference in Zurich.

Rapid Growth

Revolut has had very rapid growth since its foundation and today employs a workforce of 140 people, in offices in London, Krakow and Moscow. With the money from the investors, Storonsky plans to open new branches in New York and Singapore, hiring an additional 20 people, «Bloomberg» reported.

«These are big markets, there’s huge demand for our products,» he said. «We’ve got waiting lists and now’s the time to enter.»

The «Slow» Big Banks

In the interview with «Bloomberg», Storonsky also offered his blunt opinion about the established banking industry. The banks were eagerly watching the fintech industry’s new products to see what they would want to offer clients in the future. «But they’re very slow,» he said.

Storonsky strongly believes that offering clients the chance to own and use cryptocurrencies is big step forward for the financial market. But the established big banks definitely aren’t there yet.