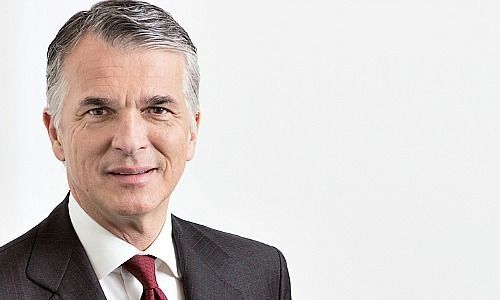

The head of Switzerland's largest bank sees digitization hitting banking as hard as the raft of financial regulation following the crisis of 2008-09. Sergio Ermotti isn't excluding UBS from the trend – addressing a stigma.

It has been the toughest lesson of his more than 40 years in banking, UBS boss Sergio Ermotti told «Bloomberg» in a wide-ranging interview: letting go staff and offices. But CEOs needed to be willing to «kill your darlings,» as he put it.

Bank bosses had to recognize that some things change, and be able to move on from an emotional attachment, he said.

No «Big Bang»

Ermotti sees banking facing its next huge challenge: digitization will roil the sector as much as a wave of regulation following the financial crisis which tipped many financial firms – including UBS – into state rescues in 2008 and 2009, he says. However, the shift will happen in stages, and not like a «Big Bang» like the deregulation of finance in the City of London in 1986.

The changes will cost jobs, he warned. «I’m not telling you anything new: We see a lot of contraction in the number of people in our industry.» UBS could shed as much as 30 percent of its 95,000 employees and contractors, he said – which translates to 28,500 jobs.

The jobs will be «much more interesting» and include a healthy human component, he said: «I’m totally convinced that our jobs and industry will continue to be very interesting and challenging.» His comments echo those of Deutsche Bank boss John Cryan, who last month warned that robots are coming after jobs at the German bank.

Search for «Superbank»

The Swiss bank boss appears to be willing to make sacrifices for the virtues of technology: instead of catering to 50 clients, advisors will soon be able to serve 100 clients and do so more thoroughly, he hopes. A more digital banking world will also help financial firms to lower their costs. «I’m convinced that you need to continue to invest in that sense,» he said.

Ermotti still hopes that banking will find ways to introduce a common infrastructure – a utility – which could be a lifeline for smaller firms and make a dent in the costs of larger ones.

The UBS boss was one of the first to float the idea of a «superbank» for banks to hitch onto and draw certain, non-sensitive joint services from, but fiercely protective banks have launched no specific projects. For its part, UBS has pooled part of the information technology at its private bank, which it could later offer to outside firms.

Switzerland Not Sacred

The 57-year-old native of Ticino indicated that he was willing to break with several long-held taboos and traditions of conservative Switzerland. Asked about Swedish Nordea's decision to shun Stockholm and opt for Finnish headquarters, Ermotti said he had a great deal of respect for the Scandinavian bank and its decision.

Nothing in banking is a given anymore – not even that UBS remains in Switzerland, Ermotti said. For the moment, being Swiss carries a certain weight, but Swiss CEOs shouldn't just sit by idly should it become a burden or a disadvantage, he said. «People should never take things for granted, because nowadays nothing is 100 percent.»