Yet another data leak has exposed the lengths to which the world's wealthy go in hiding their money. A surprising revelation? The Caribbean is losing out as an offshore money haven.

The International Consortium of Investigative Journalists (ICIJ) has released another data cache after last year's «Panama Papers». The Washington, D.C.based consortium unveiled the «Paradise Papers», a trove of 13.4 million documents curated by various media outlets reveal secret offshore constructions and out high-profile figures including the Queen Elizabeth.

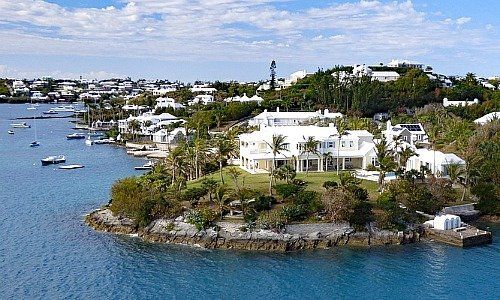

The source of the leak is once again a Caribbean legal firm: Appleby, based in Bermuda's capital, Hamilton, with roughly 500 employees worldwide. As Germany's «Sueddeutsche Zeitung» reported, the law firm is the door to «the shadowy world of big money.»

That is charitable. In fact, Caribbean offshore havens are overshadowed by other financial centers – when big money needs a haven, it is looking elsewhere.

Top-100, Not Top-Ten

The trend emerged even before the Panama Papers wer leaked last year: according to a 2015 Deloitte study, offshore centers in the Caribbean were struggling to stem a massive outflow of assets – between 2008 and 2014, assets in the region shrank by half to $900 billion.

A look at September's «Global Financial Centres Index» shows that the once-mighty Caribbean islands are now effectively also-rans. While some countries have recovered lost ground, the Bermudas have slipped to 29th, the Bahamas 81st and Panama 88th.

The other side of the equation: London leads the list, which is rounded out by Zurich, Singapore, Shanghai and Beijing, among others.

«Dynamic Center» Washington D.C.

In terms of reputation, several Caribbean money centers are at the lowest end of the GFCI scale – and the newest revelations will do little to change that.

- Page 1 of 2

- Next >>