By contrast, the more «dynamic financial centers» include few Caribbean names (see graphic below). Instead, this list includes hubs like Abu Dhabi, Luxembourg and Shenzhen – and Washington D.C, the U.S. capital and home of the ICIJ reporting consortium.

In fact, the U.S. was already managing one-third more offshore money in 2012 than the Panama and Caribbean. Two years later, the U.S. managed $1.4 trillion, behind the U.K. and Switzerland. U.S. states like Delaware, South Dakota, Nevada and Alaska are jockeying to manage offshore stashes, with age-old methods like letter-box companies and foundations.

«Giant Sucking Sound»

The big money prefers the U.S. to the Caribbean, it would seem. As former UBS banker and tax lawyer Peter Cotorceanu noted last year: «That ‘giant sucking sound’ you hear? It is the sound of money rushing to the USA» in order to avoid automatic data-sharing agreements taking hold.

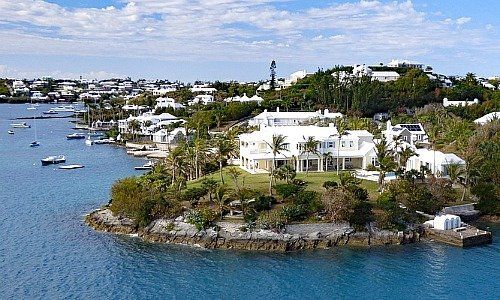

So how soon until the first Delaware leak emerges? To be sure, the ICIJ's network of journalists would have far less to go on than in older financial centers: unlike in the Bermudas, for example, Delaware firms aren't even required to identify their beneficial owner.

- << Back

- Page 2 of 2