The structured products vendor entered the Asia market last year in Hong Kong and Singapore. finews.com reports on how the Swiss bank plans to keep spreading out.

Vontobel's top investment banker Roger Studer told finews.ch-TV in an interview last year how he planned to gain a foothold in Hong Kong's bustling structured products market.

The Swiss bank came to the world's largest derivatives market with considerable ambitions: it wants to list roughly 600 products in Hong Kong, and win market share of 10 percent, Studer said. Overall, the bank wants to lifts its Asian revenue to roughly 30 percent of its total – even with Switzerland and wider Europe.

Singapore Strike

One year ago, Vontobel stole a march on rivals with a product tie-up with Bank of Singapore, a deal which also encompasses the distribution of Vontobel's financial products. The bank's structured product push began turning a profit in November on total Asian derivative turnover of $5.7 billion, Vontobel boss Zeno Staub said in Zurich on Tuesday.

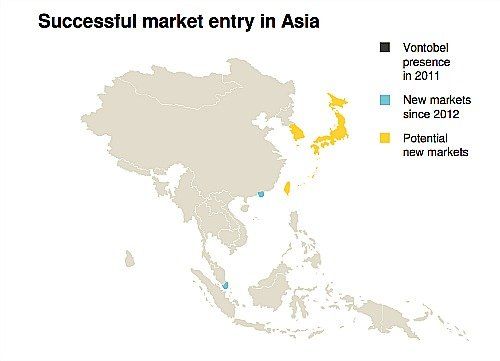

This is just the start, according to Staub: Vontobel is already looking outside of the two main Asian financial hubs towards Japan, South Korea, and Taiwan as potential markets (graph below).

Staub told finews.com he hasn't set a timeline for tackling Japan, for example, saying the bank wants to win more market share in Singapore and Hong Kong first.