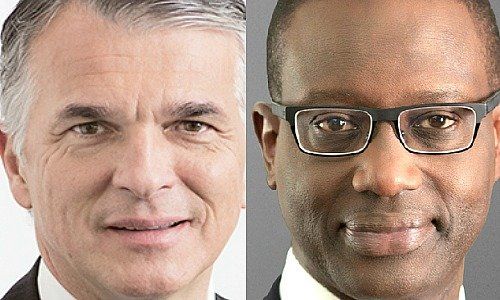

Which would also work as a reason for Thiam's bonus boost: One of his main tasks is to improve wealth management performance at Switzerland's No. 2 – with the private bank being the main focus.

4. Widening Gulf

The majority of Swiss bankers will face something else entirely. Looking at what the big banks listed under personnel expenses, the way forward is clear: wages are under pressure. Credit Suisse cut the number of full time equivalent positions in 2017 by 1 percent to 46,840, but pay overall dropped 4 percent to 10.2 billion francs.

At UBS, spending on staff was up 1 percent to 15.9 billion in 2017. The number of jobs however rose 3 percent to 61,253. On average, wages have fallen – with few notable exceptions at the top and for private bankers (see Point 3). So the gulf between the average high-street bank employee and the bosses at the top is widening further.

5. Sharing is Caring

Credit Suisse changed its dividend policy in 2017 after shareholder unrest – promising to pay a dividend of 0.25 franc per share in cash instead of in the form of new shares. Swiss-domiciled shareholders don't need to pay income tax on the dividends.

UBS also promised a higher income to its shareholders, targeting an annual dividend increase of a mid- to high-single-digit percentage. It will also buy back as much as 2 billion Swiss francs over the coming three-year period.

Dividends and share buyback programs are possible if equity is strong. Capital management is an important criteria for the size of Ermotti's and Thiam's compensation package.

- << Back

- Page 2 of 2