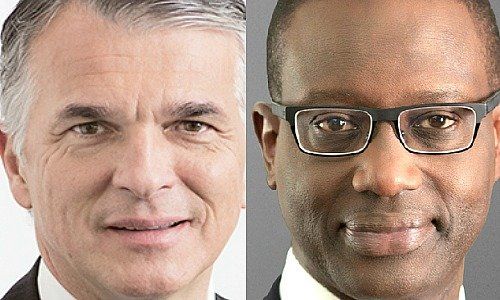

It doesn't take a crystal ball: the 2017 bonus season will be very kind to Sergio Ermotti and Tidjane Thiam. The duo may even bump into a sonic pay barrier, finews.com shows.

At UBS, the die is cast: the Swiss bank publishes its annual report including pay scales for top management this week. Credit Suisse will do so in two weeks, but has likely already allotted year-end awards, as finews.com previously reported.

What can Sergio Ermotti at UBS and Credit Suisse boss Tidjane Thiam expect in their red envelopes? And how much will Boris Collardi take home for his last year as head of Julius Baer?

The benchmarks are awards from 2016, while criteria is performance by the bank as well as the CEO, and other metrics. Ermotti took home a total of 13.7 million Swiss francs one year ago, while Thiam was awarded 11.9 million francs – that is before he and other Credit Suisse top bankers agreed to a pay cut following widespread criticism. Collardi notched up 6.5 million francs at Julius Baer.

finews.com's prediction: Ermotti will bump up against a 15 million franc pay barrier for the past year, according to last year's compensation report. Thiam has the same cap, while at Julius Baer the limit stands at 7.5 million francs.

finews.com lists five reasons why the CEOs are in line to reap record pay packages last seen before the financial crisis of 2008/09:

1. Business Is Good

Both banks are demonstrably doing better: at Credit Suisse, Thiam recorded the bank’s third consecutive loss due to a billion-franc hit after U.S. tax reforms. That aside, he is wrapping up a grueling three-year restructure including two cash calls for a total of 10 billion francs as well as preparations to list the lucrative Swiss unit (later shelved).

For his part, Ermotti eked out a 1.17 billion franc profit despite a hefty hit from the tax reforms. UBS said it would keep lifting its dividend and launched a 2 billion franc share buyback – its first since the financial crisis. Business is good: both Swiss giants continue to hoover up assets in growth markets like Asia, and scandals such as a French tax investigation at UBS or Credit Suisse’s legal skirmishes in the U.S. appear to be receding. In short, both Thiam and Ermotti have done their jobs for shareholders.

2. Wall Street CEO Pay Surges

Credit Suisse, UBS and Julius Baer have always emphasized that the size of their top management pay packages depend on their performance. In truth, performance plays a subordinate role. It is much more important what peers at rival banks are earning.

And that's what will put the smiles on the faces of Ermotti, Thiam and Collardi. Goldman Sachs CEO Lloyd Blankfein received $24 million, Jamie Dimon at J.P. Morgan took $29.5 million, Morgan Stanley CEO James Gorman $27 million, Michael Corbat at Citigroup $23 million and Brian Moynihan at Bank of America $21.5 million.

They all received a higher compensation than for 2016 and some – as for instance Corbat – were awarded a substantially higher bonus. That's a clear indication for the CEO compensation packages in Switzerland.

3. Golden Times for Private Bankers

The top executives won't however have been the only ones to take home more than ever. At Credit Suisse, signs are that the bank moderately increased the total bonus pool. But the private bankers at Credit Suisse's private bank reportedly were awarded richly. The Iqbal Khan-led unit had substantial net new money growth in 2017.

- Page 1 of 2

- Next >>