The champagne mood in Swiss private banking is certainly reflected in the results of an international survey by the banking federation. However dangers also lurk, and in many areas.

Swiss private banks have withstood the upheavals in the sector in recent years fairly well. But the «clean money» strategy, greater tax transparency and generally tighter regulation have seen a consolidation in the Swiss private banking sector that has yet to run its course.

Swiss private banking remains the yardstick in the global competitive market, with Swiss institutions controlling around a quarter of cross-border private client business.

Challengers Poised

As the umbrella body for the sector, it is especially important for the Swiss Bankers Association, or SBA, that the good framework in Switzerland is maintained and that the sector’s economic weight is recognized in order to retain and improve its competitiveness.

The supremacy of the Swiss cross-border business is being challenged by a number of global locations: Great Britain, Germany, Luxembourg and the Channel Islands in Europe. Hong Kong, Singapore and increasingly China, die USA with its offshore centers Miami und New York, as well as Dubai in the Middle East and the Bahamas in the Caribbean.

Room to Improve

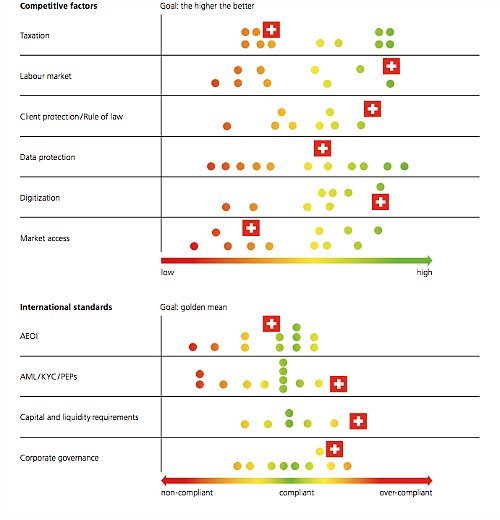

The Swiss lobby group has taken a closer look at the political and regulatory frameworks in Switzerland and its global competitors. The results show there is room for improvement, especially in the areas of market access, taxation and capital regulation. It also highlights the Swiss trend towards over regulation.

This is how Switzerland measures up:

1. Automatic Exchange of Information (AEoI)

Switzerland’s adoption of standardized data-swapping arrangements with partner countries is on course, if not as well advanced as Hong Kong or Singapore, which have smaller democratic hurdles to overcome. The Swiss lobby also recommends sustained pressure be applied on the USA to adopt standards agreed at the OECD, or Organization for Economic Cooperation and Development, to ensure a level playing field.

2. Money Laundering

The latest Financial Action Task Force, or FATF, report has delivered a favourable assessment of Swiss banks, even by global comparison. Among the criticisms are, for example, a lack of sensitivity towards the growing threat of terrorism in Europe, and how it could impact on financing and selfregulatory organisations. The SBA recommends certain actions to maintain Switzerland’s good standing.

3. Capital, Liquidity

Here the report notes the tendency for overreaction, with certain international standards being exceeded. This is especially so after the introduction of so-called too big to fail rules, where no further measures are needed.

4. Corporate Governance

The report only awards the Singapore banks a higher corporate governance rating. Here again Switzerland shows a trend towards «over compliance» and international standards tend to be exceeded. Thus a «Swiss Finish» should be avoided.

5. Client Protection

Here, Swiss banking scores on its traditional strength as a politically stable country with a reliable legal system. It still needs greater harmonization with European Union regulations to bring the two closer into line. So the Finsa and Finia financial market rules on improving client and investor protection are important. In the case of data protection the alignment with the EU is well under way.

6. Digitization

In this field, Swiss banks – together with British institutions – lead the way internationally, and display a high degree of flexibility.

7. Labor Market

Switzerland also scores here with very employer-friendly policies. Nevertheless structural adjustments are still needed, particularly as they affect the social security and pension systems, and the country’s relationship with the EU.

8. Taxation

Here we find the biggest deficiency, namely Switzerland is the only country which imposes a stamp tax. This has a negative impact on the funds and structured product businesses. In addition the trade in Eurobonds suffers in Switzerland, by comparison with London. The message is clear: scrap the stamp tax.

9. Market Access

Here Switzerland lags behind its Luxembourg and German rivals. Both are likely to be the biggest beneficiaries of Brexit. EU market access for Swiss financial institutions has long been a Swiss demand, but judging by its success thus far, remains no more than a political dream.