Zurich is losing ground compared with other financial centers, along with Geneva, Frankfurt and Luxembourg. The reason given for its decline will hurt the bankers.

After the most recent rise back among the top 15 financial centers, Zurich and Geneva are back to square one. If the «Global Financial Centers Index» (GFCI) is taken at face value, Swiss banking is staring into the abyss.

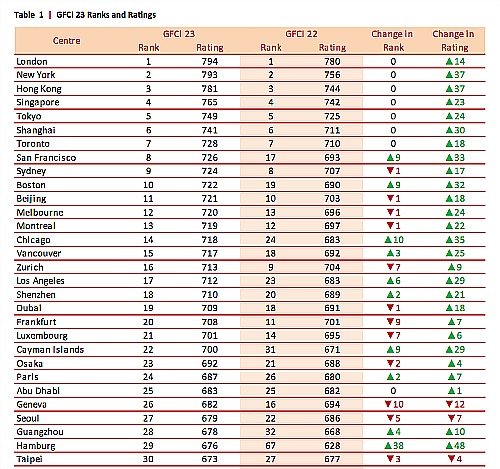

Zurich and Geneva have both dropped substantially over the past six months, according to the index compiled by the London based think tank Z/Yen Partners. The home of UBS and Credit Suisse placed 16, down seven, while the home of private banking dropped ten places and came 26th (see table below).

London, New York and Hong Kong came top, unchanged in their ranking. Frankfurt dropped nine place and Luxembourg seven, two other traditional European centers. This is the result of a survey among 2,300 professionals in the finance industry.

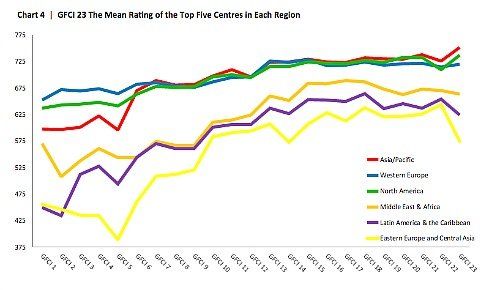

The development is also mirroring the global shifts, whereby Asia and America have made up ground compared with Western Europe (see table).

In the latter region, Zurich and Geneva still hold their strong position with ranks 2 and 6. Still, Hamburg, Munich, Monaco, Madrid, Paris and Jersey have gained in attractiveness. They seem to count among potential winners of the Brexit.

Why It Really Hurts

The Swiss centers are doing relatively less well in rankings of reputation, human capital and infrastructure – they both rank outside the top 10 on the three counts. This will hurt the financial markets because Switzerland has always been proud of its excellence in those respects.

The rankings may not really reflect reality that well – after all, they each are being sponsored by a different financial market. This time, the turn was on Kazakhstan and its capital Astana, which was ranked for the first time and duly climbed to 88th out of 96 positions.