Of course, the reputation of bitcoin and other cryptocurrencies isn’t spotless. Experts left and right are issuing guidance, warning of pyramid schemes and money laundering. The Bank for International Settlement only just released a report that came to a damaging conclusion about digital currencies.

When Jamie Dimon, the CEO of J.P. Morgan last fall said he would fire anybody who traded in bitcoin, he was in good company. However, the problem he shared with all his colleagues across the world was that demand for the coins soon went through the roof –and the currency exploded in value.

Digging for Gold

Since then, the currencies have come down from those extremes but the vast number of coins and tokes as well as the hunger for initial coin offerings (ICO) show that the story hasn’t gone away. Capgemini recorded 195 ICOs from January through April of this year with a collective value of $6.2 billion.

The digging for gold has kindled the interest of the rich. A crypto conference in St. Moritz in the Swiss Alps earlier this year attracted wealthy folks such as Jorge Paulo Lemann, hedge fund pioneer Rainer-Marc Frey, and banking scion Raymond Baer.

Law of Supply vs Demand

To pretend that this isn’t the case would be akin to break with the law of supply and demand. Rich people are always finding ways to get richer – or to lose a lot of money for that matter.

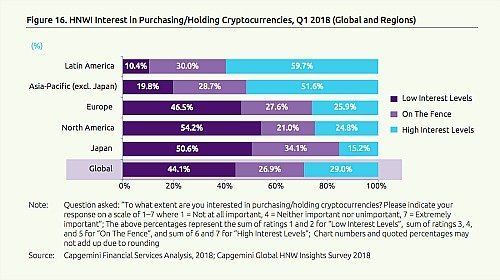

The potential for private banking can be seen in the Asian and Latin American markets in particular. Regions, where a lot of new wealth is being created – and where the interest in cryptocurrencies is the largest (see table below).

A cursory glance at all regions and clients shows that if banks were to help their clients with advice for how to invest in crypto products and how not to, they would gain a wealth of the crucial currency that is worth much more than bitcoin, ether, dollar or franc – trust.

- << Back

- Page 2 of 2