The production of cryptocurrencies isn’t – as is widely believed – a prerogative of the many, but in the hands of a very few people, Hyun Song Shin, chief economist at the Bank for International Settlements, tells finews.com.

Will cryptocurrencies such as bitcoin soon replace the franc and the dollar?

Certainly not. They lack all the attributes that distinguish traditional money and which makes it so popular.

Could you please elaborate?

The miners, the people who generate bitcoin with the help of a lot of computer capacity, don’t just produce cryptocurrencies, they also administer each unit.

The miners, just like accountants, have to keep an electronic protocol of each transaction in which cryptocurrencies have been used. This requires an effort and generates costs. Therefore, the use of cryptocurrencies involves paying a fee.

«Miners are doing good business»

If demand for cryptocurrencies is high and computer capacity low, the fees will be high. The miners are doing good business.

And users of cryptocurrencies inversely have to pay more. Why?

I will use an example to explain: in December, the fee for a payment was an average $57. If you were to pay a $2 coffee in bitcoin, you’d have to add $57 in fees.

«This problem doesn't exist with traditional currencies»

The miners therefore have an interest in keeping fees high, or put another way, create tailbacks. But this makes cryptocurrencies less attractive. Experts call this a lack of scalability. This problem doesn’t exist with traditional currencies. You don’t have to pay a fee for buying bread at the bakery with Swiss francs.

Are there any other factors that can be held against cryptocurrencies?

You can’t be sure if you will in future be able to buy something with your expensively acquired cryptocurrency. Contrary to what people believe, the production of cryptocurrencies is in the hands of very few and not the many.

Miners can quite easily come to an agreement and pull forward, not process or even cancel certain transactions. If you have a ten-franc note, you can assume that you will get something in the shops for this traditional money.

You have central banks behind traditional currencies, that are part of a political system and are under public control. This engenders trust. Without the trust of citizens in the purchasing power of currencies, they are worthless.

In the past, countries have ruined their currencies through mistaken policies…

True. And I don’t want to suggest that every traditional currency is totally stable and safe. However, I want to point out that the alleged advantages of cryptocurrencies are being exaggerated in public. Cryptocurrencies for sure aren’t a panacea.

Criminals love cryptocurrencies. What do you suggest should regulators do to contain or even prevent this abuse?

A complete ban would be the wrong way. Cryptocurrencies would descend into the shadow world where they would be even harder to control. The same rules should apply for cryptocurrencies as for other asset classes.

Are cryptocurrencies a danger for the stability of the financial system?

The volumes of cryptocurrencies are very small compared with other currencies. This puts their importance in perspective.

- The interview was conducted by Bernd Kramer, a business editor at «Badische Zeitung» in Freiburg, Germany.

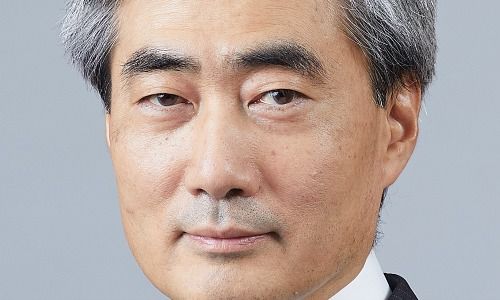

Hyun Song Shin, 59, a South Korean citizen, for the past four years has been chief economist of the Bank for International Settlements (BIS) in Basel. He studied philosophy, politics and economics at University of Oxford. He was a lecturer at the London School of Economics from 2000 through 2005 before moving on to Princeton. In 2010, Hyun Song Shin advised the South Korean president and influenced the financial stability policies in the Asian country.