Julius Baer CEO Bernhard Hodler isn’t just following the rhetoric of his predecessor, Boris Collardi. He’s also aiming high as far as his «seasonal goals » are concerned.

«Julius Baer is firing on all cylinders», CEO Bernhard Hodler told a group of international analysts and reporters on Monday in reference to the private bank’s half-year earnings report.

His quote may not exactly fit Julius Baer’s sponsorship of the Formula E racing circuit, but it doesn’t deviate much from how former CEO Boris Collardi would have described the result. Julius Baer is a well-oiled wealth management machine, which continues to develop the horsepower needed: more client money, higher profit and geographic expansion.

M&A as Strategic Aim

Hodler’s presentation suggests he has changed little in the growth strategy inherited from Collardi: this applies to takeover activity, the hiring of new client advisers as well as the completion of other items on his agenda.

In the past six months Julius Baer took over the Brazilian wealth manager Reliance, consolidated the Italian asset manager Kairos and founded the Thai private banking joint venture with Siam Commercial Bank.

Consolidation to Speed Up

The 59-year-old CEO had intended to make Julius Baer’s growth independent of acquisitions and to reduce client adviser hirings. This doesn’t look tob e the case now, despite Hodler’s assurances that the third pillar of his strategy, internal growth creation from cross selling is working.

Takeovers are still top his agenda. He expects ongoing consolidation in the private banking sector and doesn’t rule out larger acquisitions which may require funds from the capital market and shareholders.

«Seasonal Target» Hit

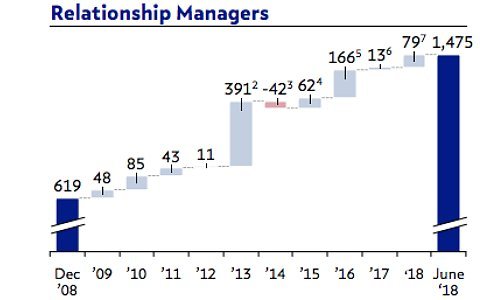

The new client advisers who have joined this year will need to drive growth – especially in Germany and the U.K. A glance at the statistics show 79 new advisers (including 13 from Reliance) is close to a record. Only in 2010 did Julius Baer hire more advisers.

Hodler’s «seasonal goal» was 80 advisers spread over the year. Hodler wouldn’t say whether the pace will quicken, only that it could have been a lot more and that the hiring will have an impact on growth this year.

Hodler is thus sticking to Collardi‘s strategy, and the earnings justify this. Julius Baer and Hodler aren't the only ones relying on recruitment to foster growth – most Swiss wealth managers are betting on advisers bringing in new client money. However this strategy is more expensive and no guarantor of sustainable growth.

Growth Musn’t Dry Up

The CEO said as a rule client money from new advisers generally materializes within four years. The hiring should ensure the bank generates a constant new fund inflow. Hodler will have to continue recruitment so this money source doesn’t dry up.

A glance at the Swiss private banking sector shows a wealth management moving to a reduction in expensive advisers and to more investment in digital asset management.

With Julius Baer’s wealth manager focus, the «human factor» will remain important in the long run, Hodler stressed, but acknowledged also that Julius Baer will invest heavily in automating processes.