CEO Tidjane Thiam sees most of his turnaround targets at Credit Suisse as fulfilled. Gauging the exact progress of the bank since 2015 requires closer examination, finews.com argues.

Tidjane Thiam called time on a three-year restructuring of Credit Suisse: the Swiss bank's CEO ticked off more than a dozen tasks as completed when he faced investors on Wednesday.

In future, he wants to be measured on one benchmark: returns. This will make it easier for investors and observers of the Zurich-based institute to differentiate between successes and misses.

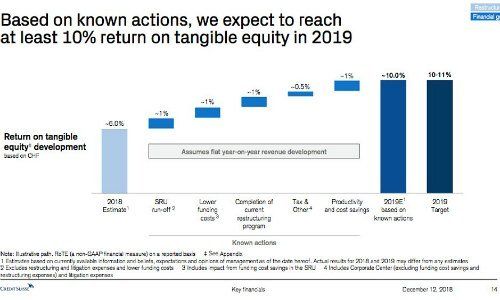

Finance chief David Mathers also showed how the bank wants to crack the 10 percent threshold for return on its toughest form of capital. Conspicuously, Credit Suisse isn't factoring in revenue growth next year in this particular measure.

Instead, Mathers explained how the bank wants to cut spending over the next three years. A «bad bank», or strategic resolution unit, is to be shuttered, pricey interest payments to Qatar on crisis-era instruments will fall away, and costs for restructuring and job cuts have also tapered.

Creative Comparisons

As solid as this seems, it lacks fizzle, as the initial shrug from Credit Suisse investors illustrated. By contrast, Credit Suisse let loose its creative side in a comprehensive slide show depicting its successes.

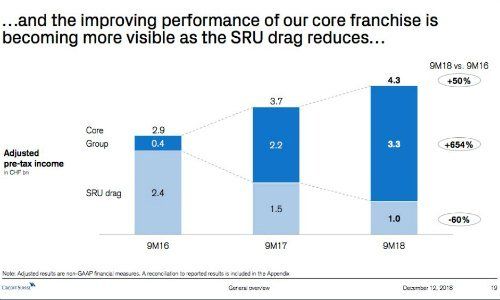

Particularly noticeable in marking the progress since October 2015, when Thiam unveiled the restructuring strategy, is that comparison values have shifted. If Thiam usually references the year before his revamp as the base value, he refers back to 2016 when it comes to profits (Credit Suisse has yet to record a full-year profit under Thiam, but said earlier on Wednesday that it will for 2018).

A glance at the specifics reveals the reason: the bank recorded 1.8 billion Swiss francs in net profit in the first nine months of Thiam's first year, which is more than in the same period this year. The business Credit Suisse refers to as «strategic» looks even worse, though the comparison is difficult after three years of tough spending cuts.

Financial Wiles

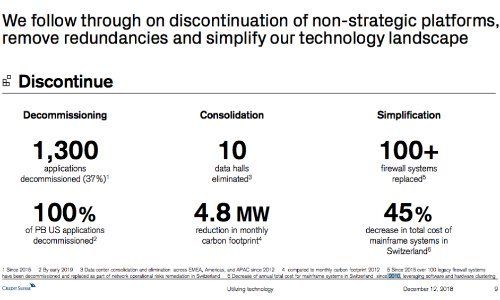

A further legacy area reveals another case of numbers-juggling: in information technology, or IT. Operating chief Pierre-Olivier Bouée requires six footnotes for exactly as many key figures.

The comparison figures range from 2010 to 2019. Next year, Credit Suisse plans to definitively dump the technological vestiges of its former North American private banking arm (which was offloaded to Wells Fargo more than three years ago).

The subterfuge likely doesn't help Credit Suisse at all: most people who look at the reams of slides don't do it for their health, meaning they are paying close attention. Overly optimistic depictions which don't stand up to closer scrutiny, or constantly-shifting benchmarks, only serve to aggravate investors. This translates to a general distrust of promises made by the bank's C-suite.