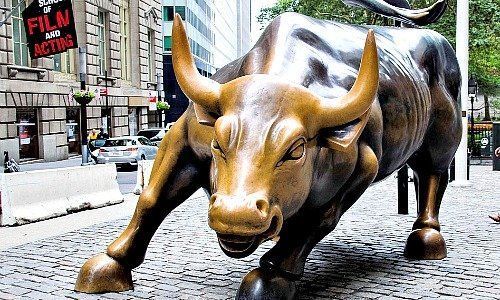

The big banks on Wall Street have never had a better year than in 2018. How did the two big Swiss banks fare in comparison?

UBS and Credit Suisse frequently get assigned the same status as the six biggest U.S. investment banks. The results of 2018 however show that the two Swiss banks no longer play in the same division.

The six big U.S. banks together generated a profit of $100 billion, according to «Bloomberg». This is a record for these banks.

UBS Lags U.S. Rivals

The bank among the six institutes with the lowest profit, Morgan Stanley, had net income of $8.7 billion. This is more than double the amount that UBS earned in the first nine months of the year.

It is unlikely that the Swiss big banks anytime soon will post similar record profits they had before the financial crisis, because they reduced the level of risk in their business. Also, they still haven’t freed themselves fully from the legacies of past times with some fines and legal disputes still to be dealt with.

Investment Banking Change

The two banks’ trimmed investment banking divisions can’t contribute as much to their profits as they did before. And the European banks have in any case lagged the performance of the U.S. banks in the recent boom of the world’s largest economy.

Wealth management, the two banks’ pride, are suffering with clients holding back on investments on concern about declining stock prices. In their outlook for the UBS report due on January 22 analysts at Morgan Stanley expect it to show that margins in private banking have narrowed further.

Strong on Equity and Forex

By contrast, the analysts expect good news from the trading desk at Switzerland’s biggest bank. «We think UBS investment bank should have performed relatively better than other IBs in the quarter,» said Giulia Aurora Miotto, Magdalena Stoklosa and Danny Anson-Jones. UBS is profiting from its strong equities desk and forex trading.

The focus on these markets was the consequence of the repositioning initiated by CEO Sergio Ermotti, a bid to return to the core strengths of the bank. One of its advantages is that the investment bank can compensate for lower returns at wealth management during times of higher market volatility.

Trump Effect

CS will likely have slumped to a loss in the fourth quarter, as the trading division – Global Markets – continues to cause a headache for CEO Tidjane Thiam. Switzerland’s second-largest bank will publish its set of figures on February 14.

U.S. banks have another point that speaks in their favor, apart from their higher risk exposure. The tax cuts introduced by the Trump administration gave corporate America a boost, combined with rising interest rates and a record labor market that boosted confidence among the retail clientele.

Long-Term vs. Short-Term?

Under the current conditions, it is unlikely that Swiss banks will manage to close the gap to the U.S. brethren in terms of both share price development and profit levels. The management of the banks and shareholders will have to bide their time.

We will find out whether or not it was worth cutting down after the last crisis, once the next recession is here. If the profitability of the U.S. banks reacts to the extent that it did to the positive stimulus of last year, the turn will be on Ermotti and Thiam to celebrate their own wisdom.