Clients of Swiss private banks are getting increasingly demanding with respect to their investment portfolios. A simple offering containing a range of equities won't do anymore.

Last year was tough not only for banks but also for their clients, with equity prices plunging towards the end of the year. The typical client of a private bank with heavy exposure to stocks would have seen his or her portfolio shrink as a result. Wealth managers resorted to offering more investment opportunities in alternative asset classes, for instance in the private equity market.

Banks are well advised to continue their efforts in this business. Swiss clients favor such alternative investment opportunities, according to a survey compiled by J.P. Morgan Private Bank.

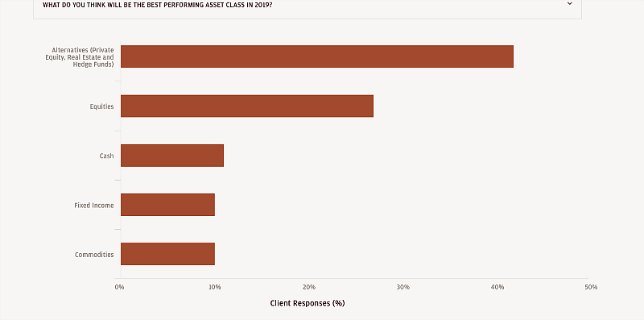

A large number of Swiss clients favors investments in private equity, real estate, hedge funds and similar products, with 42 percent of the surveyed expecting the best returns from these assets in 2019.

Biggest Worry: U.S.–China Dispute

Alternative investments are the hottest asset class in Switzerland. Only 27 percent believe that equities will have a great performance and cash, bonds and raw materials also fall away with about 10 percent each.

The biggest worry of the private banking clientele are the persistent disagreements between the Trump administration and China.