3. A Wealth and Financial Market Tax

(Picture: Shutterstock)

If there's no money left after the governments bailed out their economies, pressure will grow on them to generate more tax income. Switzerland has avoided such calls so far, because there was enough money available. This may be about to change.

One of many to call for the introduction of a wealth tax is John McDonnell, the shadow chancellor under Jeremy Corbyn. He called for a windfall tax on the financial market, which had been bailed out by the public in the financial crisis. The windfall tax on banks was to be paired with a tax on the rich and on multinationals.

Conclusion: Switzerland isn't likely to resort to such a tax. The financial market seems however slow to accept that high dividend payments and excessive bonuses don't go down well at a time when the recession will see unemployment rise sharply.

4. Switzerland Fund

Two renowned economics professors from ETH Zurich proposed the introduction of a Switzerland Fund. Some of the money for the emergency fund would have come from the distribution reserve of the Swiss National Bank (SNB). The reserve currently contains some 84 billion francs.

Polticians from the right and left in recent years had wanted to take money from the SNB reserves to safeguard the pension system – and the SNB always rejected such calls. Policy-makers say that selling foreign assets and moving them back to Switzerland would obstruct their monetary policy.

Conclusion: the SNB will object against such a proposal, not least because it fears a politicization of monetary policy. By increasing its annual contribution to the federal state and the regions the bank showed that it listened to the demands for a greater contribution, without changing the fundamental principle of central bank independence. Time only will tell whether this will hold when the times get tough.

5. A Private Infrastructure Program

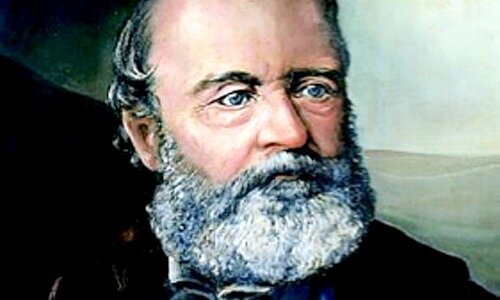

Switzerland's wealth in many ways builds on the ingenuity of its citizens. Credit Suisse for one was founded to help finance the rail infrastructure. The statue of Alfred Escher (pictured above), the man behind this story, still stands in a prime location in central Zurich.

Today, the country has a fascinating project at hand that looks highly suitable for a time of economic hardship: Cargo Sous Terrain (CST). The underground logistics network would cost some 33 billion francs, according to the promoters. Three banks, Credit Suisse, Zuercher Kantonalbank and Basellandschaftliche Kantonalbank, are among the main shareholders of this project.

Conclusion: a promising project, privately financed, with a great environmental effect that would secure a great many well-paid jobs in Switzerland. The project looks an obvious choice to be advanced as an alternative or complement to a government program.

- << Back

- Page 2 of 2