Financial market lobbyists are beating the drum for a Swiss financial center that is supposed to be the world leader in terms of sustainability. The reality is that Swiss banks are struggling to live up to this claim and are lagging behind customers' wishes.

If the billboard is to be believed, the Swiss financial center and local fund providers have made the transition to sustainable investing. No other investment topic has been promoted more by Swiss banks and asset managers in the recent past than ESG and impact investments.

Accordingly, bank clients should be under the assumption that the providers can also live up to their claims. Namely, that offering sustainable funds is no longer a differentiation factor, but a hygiene factor to meet customer needs.

ESG Is Not Mainstream At All

But that's not the case, as the Institute of Financial Services (IFZ) noted in a blog post on Monday. There is no sign of the ESG mainstream in the market for Swiss mutual funds. On the contrary, with a market share of just under 6 percent, ESG funds still represent a niche. This niche is nevertheless very attractive, the IFZ notes.

Clients are increasingly asking for these products. Fund providers are benefiting from high inflows of new money. On the Swiss fund market, every fourth newly invested franc is currently invested sustainably.

Majority Has No ESG offering

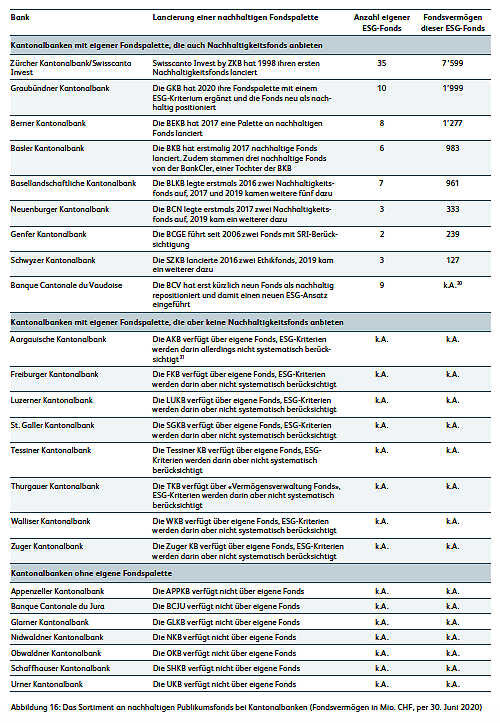

But the ESG product landscape is sparse in the Swiss market: in a study conducted last year, IFZ found that of the 24 cantonal banks, only nine institutions offer their own ESG funds. The lone pioneer here is Zuercher Kantonalbank with its Swisscanto fund brand, which has 35 sustainability products in its fan. Swisscanto launched the first of these as early as 1998.

It should be noted that of the other 15 cantonal banks, seven do not have their own funds.

The thing is: building an ESG fund range is not that easy. IFZ identified four typical implementation difficulties.

1. Knowledge Gaps

Since a proper ESG strategy requires single stock selection, challenges arise regarding the methodology for choosing exclusion criteria. What fits the bank, what fits the client? What are the best practices in selection? How do ESG criteria change model portfolios? There are knowledge gaps at the banks in this respect, says IFZ.

2. Choosing the Right Partner

Research in ESG investments is a discipline for specialists. That's why many banks choose a partner for this. But which one fits the bill, and how can this be paid for? Questions that need to be addressed include the investment universe offered, the model behind an ESG rating, or existing business relationships with a data provider. Especially the choice of the right rating model requires an in-depth discussion on the part of the bank.

3. Regulatory Aspects

Some banks launch ESG funds by «repositioning» or transforming existing products to make them «sustainable». It must be kept in mind that the fund prospectuses must be adapted accordingly and subsequently reviewed by the regulator (Finma). This can take months. Becoming an ESG provider is not a decision that can be implemented overnight.

4. Know-how of Investment Advisers

Offering ESG products poses new challenges for banks and their advisers in terms of communication and reporting. Sustainability promises must be communicated to clients in a credible and transparent manner. Reporting takes on new components in addition to the purely financial ones, which require an internal understanding. Client advisers must be trained on the subject, and in such depth that they can also master more challenging topics in client discussions.