If private banks want to save their business with the rich of this world into the future, they must closely accompany their children. As it turns out, this cannot begin soon enough.

«Are we rich?»: This question from the mouth of a nine-year-old puts the entrepreneur in quite a bit of explaining trouble. Selling your own company and raking in a handsome profit – that's one thing. Talking to the child about all that money is another. But fortunately, there are private banks.

The example comes from guidebooks published by U.S. bank J.P. Morgan, including the 50-plus-page booklet «Teaching Your Children About Wealth», which the institute put together for wealthy parents and grandparents.

The work, for which J.P. Morgan has called on not only its own financial professionals but also educationalists and youth psychologists, is also being distributed in Switzerland as part of the bank's «Nextgen» program.

Silence Takes Revenge

The powerful U.S. bank claims to serve the top one percent of the super-rich in Switzerland. And, as it turns out, their children as well – judging by the guidebook from the tender age of three.

According to J.P. Morgan, it makes sense to start financial education with the youngest. The bank is happy to provide advice and support. «We can help you in your efforts to guide the children and act as a role model,» it says.

Delicate Balancing Act

Wealthy parents, the bankers add, are particularly challenged when it comes to financial education. They have to walk the delicate tightrope of making their offspring understand the sheer size of their assets – without stifling their ambition to achieve something themselves.

Keeping quiet about money is even more dangerous. The guidebook cites a study that found 70 percent of families fail to pass on wealth into the third generation. Lack of trust and communication were identified as the reasons in 60 percent of cases.

Cybercrime and Philanthropy

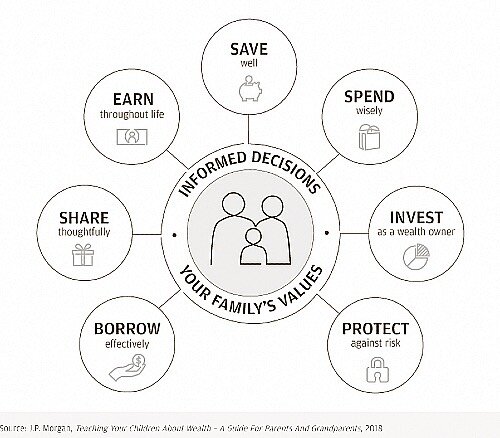

Emerging threats include cybercrime. Hackers have an easy time with children and can cause damage to millionaire heirs. Protecting themselves from this is one of seven skills that super-rich parents need to impart to their offspring, finds J.P. Morgan.

The young rich must also learn to earn, save, spend, invest, lend and share (see chart below).

All this, of course, not at once. According to the instructions, the lessons should be taught gradually with the child's age and stage of development. While 19-year-olds should already define life goals and act as philanthropists, three- to five-year-olds are still allowed to sing a ditty (although in this country centimes would have to be used instead of pennies).

One penny is just a penny

Five pennies make a nickel

Ten pennies make a dime

Twenty-five pennies make a quarter

Fifty pennies make a half-dollar

One hundred pennies make a dollar

One dollar is what I’m saving in my piggy bank!

Business With Senior Citizens

What sounds harmless is bitterly serious for the private banks. According to the business magazine «Bilanz» (behind paywall), the 300 richest people in the country owned a combined total of 707 billion Swiss francs ($756 billion) in assets last year, 7 billion more than in the previous year. Very few of the people named in this sample are younger than 50 – private banking is and remains a business with senior citizens.

This makes it all the more important to be in contact with heirs. After all, if the customer passes away, the assets are redistributed – a «liquidity event» that the competition has only been waiting for.

Accordingly, it is imperative to establish this contact at an early stage. J.P. Morgan is not the only institution that does this with some effort. With its «Young Successors Program», the world's largest private bank, UBS, offers its super-rich junior staff a series of seminars lasting several days – the program has already made headlines as «Camp Rich». Arch-rival Credit Suisse offers a similar program to its «Next Generation Education Program», while Zurich-based bank Julius Baer is one of the pioneers in the field.

The Fling With Google

Staying in touch with the next generation of heirs seems to be more important than ever for private banks in Switzerland. On the one hand, their business has been characterized by weak growth for years. New money is stagnating.

Second, surveys show that the loyalty of wealthy clients is declining: According to a survey last summer by Capgemini, a consulting firm known for its wealth studies, 74 percent of the super-rich surveyed were willing to consider wealth management offerings from big tech firms like Google, Apple, Amazon, and Facebook; 22 percent of billionaires even said they would entrust most of their money to a tech provider in the next 12 months.

It's hard to imagine what lies ahead for traditional private banking when digital natives with no financial education take the helm of the world's great fortunes.