The Swiss bank’s troubles on Wall Street are at odds with its efforts to woo wealthy entrepreneurs. A backlash in its home market undermines the key tenet of its strategy.

Nearly every year, the Swiss bank invites several hundred Swiss-based entrepreneurs to its country seat 20 kilometers south of its Paradeplatz headquarters. Credit Suisse seemed to spare no expense wooing existing and prospective clients with the lavish invites at the «Bocken», a refurbished 13th-century estate overlooking Lake Zurich: ex-British leader John Major spoke in 2019.

Other speakers at the high-octane gatherings included Chairman Urs Rohner and Thomas Gottstein, then head of its domestic unit. The bank’s message: Credit Suisse understands the concerns and fears of you, the entrepreneur. The bank’s chief historian, Joseph Jung, underpinned the message with a flattering portrayal of bank founder Alfred Escher's economic contribution's economic contribution to the development of Switzerland, one of the most prosperous nations in the world.

CEO's Baby

The idea of a «bank for entrepreneurs» isn’t Escher’s baby: Gottstein (pictured below) popularized it as part of his campaign when Credit Suisse began ring-fencing its domestic unit in the wake of too-big-to-fail rules after the tenure of ex-CEO Brady Dougan, who left mid-2015.

Five years ago, Gottstein laid out the plan at the Savoy, the Zurich luxury hotel it until recently owned across the square from its headquarters: entrepreneurs are long-term thinkers, risk-averse, and sustainable planners, the Swiss banker and his key lieutenants said.

Cold Shoulder

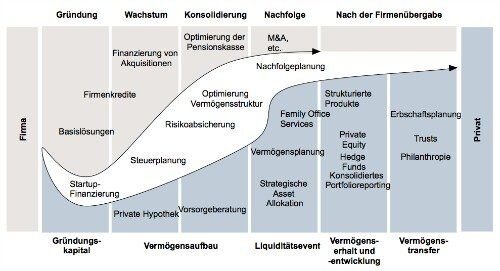

Entrepreneurs plot ahead – and «we as Credit Suisse are here to accompany and support you along the way with a tailored offering,» according to its promotional material featuring transplanted organ tissue out of a 3D-printer. The idea is to provide financing and loans to build their business, in the hopes of winning a share of their private wealth later.

(click to enlarge graphic; German-language only)

Now, Credit Suisse risks isolating the very client group it most wants to court: wealthy businesspeople. It will take an up to $4.7 billion hit for failing to escape Archegos and another as-yet-unclear billion-dollar one over Greensill, it told investors.

It is in regulatory crosshairs in several countries, its share price is down more than 70 percent in the last decade, class action lawsuits in several countries loom, and the financial burden of Archegos and Greensill wipe out an otherwise booming start to 2021.

Other Peoples' Money

Credit Suisse’s scandals lay bare that the bank effectively didn’t follow its own entrepreneurial advice, especially in view of the outsized risks it took on Wall Street. Gottstein, in the job for a little over one year now, faces a major backlash.

The response is already emerging: domestic clients, in particular, feel Credit Suisse put its money as well as its reputation at stake. «Would you do business this way if it were your own money?» Andi Odermatt, a small Swiss business owner, asks of the bank.

«Nothing Is Sacred»

Intriguingly, Gottstein seems to hew to the «one-bank» strategy despite it ringing hollow with some entrepreneurs. He told a Swiss daily the one-bank strategy positions Credit Suisse better than its rival banks.

«When it's done right, we know more about the client's financial strength and action,» Gottstein said, even as he flags a «nothing is sacred» review under incoming Chairman António Horta-Osório, who is due to take over in three weeks.

High-Profile Stumble

Selling complex financial products to wealthy entrepreneurs while catering to their business needs with plain-vanilla products like loans raises conflicts. Deciding against granting a loan or calling margin has an unfavorable effect on the bank’s wider relationship.

The CEO’s dilemma is how to square the conflicts of interest which have appeared over at least one high-profile stumble. Lex Greensill, who is a private banking client and his firm an investment banking prospect as well as until last month an asset management partner.

Unwanted Concessions

What Gottstein has left unsaid is that when «one bank» doesn’t go well, it angers clients and forces the bank into concessions it might not otherwise entertain. Credit Suisse will find it tough to defend the strategy as one which generates added value, as long as its risk-hungry investment bankers continue to destroy it so rapaciously.

Additional reporting by Katharina Bart