The Swiss bank’s chairman since 2011 is handing over to António Horta-Osório a lender in crisis. finews.com looks back at the pugnacious trial lawyer’s last decade.

Urs Rohner gave up the relative safety of a partnership at one of Zurich’s preeminent white-collar law firms to become CEO of a German media juggernaut in 2000. The chief counsel job at Switzerland’s second-largest bank lured him back to the alpine nation in 2004.

Once considered a candidate as CEO of Credit Suisse, Rohner’s path led to the Swiss bank’s board through his mentor, Walter Kielholz. Privately, Rohner has recently expressed doubts the bank can exist in its current form.

He leaves in ignominy: the bank is being roiled by Archegos and Greensill and can’t shake past scandals like corporate espionage and U.S. offshore accounts. A look at the defining moments of Rohner’s last decade, compiled by finews.com:

April 2009

Urs Rohner is elected to Credit Suisse’s board as full-time vice-chairman, after five years as the Swiss bank’s top lawyer as well as, from 2006 until 2009, operating chief.

April 2010

Rohner tells a Swiss business audience that swapping data on offshore clients with other countries is «not a feasible route» and that distinguishing between tax fraud and evasion had «if we’re being honest, never made much sense».

Switzerland ditched the distinction between fraud and evasion in 2007 under massive international pressure. Ten years later, it began exchanging client information with 38 countries.

April 2011

Rohner advances to chairman, with the backing of influential director Walter Kielholz. Finma reportedly nixed the duo’s plan for Rohner to replace Kielholz seamlessly, and ordered Credit Suisse to wait at least one year. Hans-Ulrich Doerig (pictured above), a Credit Suisse veteran, had stood in instead.

April 2012

Rohner is reelected by just 90 percent of shareholders, the poorest result by far among his board peers.

June 2012

Switzerland’s central bank orders Credit Suisse to curtail shareholder payouts in favor of padding its capital.

July 2012

Credit Suisse raises capital by issuing contingent convertible instruments to anchor investors, selling prime Zurich real estate like the Peterhof Grieder building on Paradeplatz (pictured above) and private equity holdings, asking staff to take more shares in place of cash bonuses, and cutting costs.

October 2013

«I have a strong basic trust in myself,» Rohner tells a Credit Suisse publication. «I believe I can do anything I set my mind to if I try hard enough.» An avid film buff and 54 at the time of the interview, Rohner says he has pushed back a dream to write screenplays after he turns 50.

May 2014

Walter Kielholz, Rohner’s staunchest backer, leaves Credit Suisse’s board after 12 years.

Ten days later, Credit Suisse pleads guilty to conspiracy and pays $2.6 billion to settle a U.S. criminal tax probe. Rohner tells a Swiss broadcaster «my vest is clean,» or his conscience is clear.

Two days after the settlement, the U.S. deputy attorney general criticizes the «tone at the top» of Credit Suisse and blames the bank’s «inadequate cooperation» and delaying the agreement.

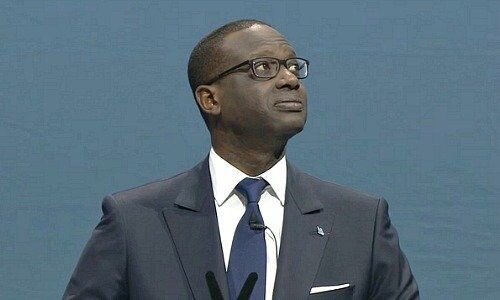

March 2015

Rohner orchestrates Credit Suisse’s hire of Tidjane Thiam (pictured above) as CEO from June 2015 and retires Brady Dougan after eight years in charge.

April 2015

Rohner is reelected by more than 96 percent of Credit Suisse shareholders.

October 2015

CEO Thiam launches 6 billion cap Swiss franc ($6.6 billion) cap hike to replenish Credit Suisse’s depleted capital and enable a wide-ranging restructuring, including a plan to list its crown jewel: a Swiss universal bank.

February 2016

Credit Suisse discloses a $1 billion write-down on illiquid positions, the bulk on securitized products like collateralized loan obligations and distressed credit. The bank won’t return to an annual profit until 2018, after three loss-making years.

March 2017

Credit Suisse is forced to back down from paying Rohner almost 4 million francs and CEO Tidjane Thiam 11.9 million francs, for a year in which the bank’s share price fell by one-third. It also promises to abandon so-called scrip (share-based) dividends in favor of cash.

April 2017

Credit Suisse scraps a plan to list its Swiss unit, tapping shareholders in a 4 billion franc cap hike instead to bolster its capital once again.

The same month, Swiss investor adviser Ethos calls for Rohner to step down, saying he is the «wrong man» to lead Credit Suisse into a new era.

Rohner is reelected by 90 percent of investors several weeks later. Noreen Doyle, a lead independent Credit Suisse director and vocal vice-chairman, leaves the board after hitting term limits.

February 2019

Credit Suisse emerges from a grueling three-year restructuring and three consecutive net losses with a 2.02 billion franc net profit.

October 2019

The Swiss bank admits spying on top executive Iqbal Khan, after it emerges that he was defecting for a top job at larger Swiss rival UBS. Credit Suisse terms the incident isolated; this proves untrue when at least one other top executive – Peter Goerke – was later also found to have been tailed by investigators working for the bank.

The tawdry scandal tarnishes Credit Suisse's reputation and delays Rohner's exit.

February 2020

Credit Suisse’s second-largest shareholder, Harris Associates, mounts a campaign to unseat Rohner. Representing the biggest threat to Rohner thus far, the effort is ultimately unsuccessful.

Credit Suisse dismisses CEO Tidjane Thiam, replacing him with domestic boss Thomas Gottstein. Rohner agrees to leave the following year.

April 2020

Rohner wins just 77.50 percent of approval from shareholders for another year – a record low.

October 2020

Credit Suisse apologizes for a racially insensitive episode during a lavish private party for Rohner’s 60th birthday which was attended by CEO Thiam.

December 2020

Credit Suisse wins António Horta-Osório as its next chairman, in a search spearheaded by vice-chairman Severin Schwan, CEO of Swiss drugmaker Roche. Portuguese native Horta-Osório led Britain’s Lloyd’s out of turmoil after the 2008/09 financial crisis.

The same month, Finma discloses it will investigate Credit Suisse’s governance over the corporate spying scandal. Rohner has led the Swiss bank’s governance and nomination committee since 2011.

March 2021

Credit Suisse pulls the plug on a $10.1 billion line of supply chain funds with Greensill that it had touted as a promising asset management niche just three months before.

The bank subsequently scrambles to limit the damage in other parts of its business: its investment bank had hoped to publicly list Greensill U.K., and its wealth management arm had reportedly banked founder Lex Greensill (pictured above). It warns of clients pulling money and damage to its reputation as a result.

Two weeks later, Credit Suisse reveals it will book a 4.4 billion franc hit due to Archegos’ collapse. The family office-hedge fund issue and Greensill spark two separate board-led probes – as well as regulatory investigations in the U.S., Switzerland, and the U.K.

April 2021

The bank accepts resignations from risk and compliance overseer Lara Warner as well as top investment banker Brian Chin. Credit Suisse reneges on two-thirds of 2020’s dividend and halts an 1.5 billion stock buyback.

Rohner, reportedly deeply shaken and fearful of a similar fate to disgraced former UBS overseer Marcel Ospel, waives part of his pay, and eschews the traditional Swiss «décharge» backing from shareholders.

One week later, the bank is forced to tap anchor shareholders and super-rich individuals for a $1.9 billion injection to its capital.

Rohner (pictured above), now clad in ignominy, hands over to Horta-Osório on April 30. His legacy stands in stark contrast to the more than 34 million francs he has taken home over the last decade as chairman, a period in which the Credit Suisse's share price has slumped by three-quarters.

Claude Baumann contributed reporting