Many Swiss private banks are struggling to find their way in the digital world, with many of them falling behind universal and neobanks, but three of them are ahead of the pack, a study shows.

Almost 30 percent of the 29 Swiss private banks surveyed in a study by Columbus Consulting offer no mobile application. Most of the apps focused on mundane functions such as portfolio advice, access to financial publications and secure messaging, Columbus said.

Private banks offering more advanced functions such as payments, trading or even access to virtual advisors were even more of a rarity, the study showed. These functions were more likely to be offered by Asian private banks and universal banks. These trading apps even offered customizable dashboards, which provided tools for effective portfolio analysis, the study said. Universal banks also offered innovative remote advisory solutions, something finews.ch tried out for itself and found to be relatively reliable.

Three Standouts

One of the results of the private banks' digital reticence was that they placed little importance on digital marketing. They tended to favor visual marketing, i.e., banners, to reinforce their brand image. This contrasted with universal and digital banks, which invested mainly in search engine optimization to promote more specific products, Columbus said.

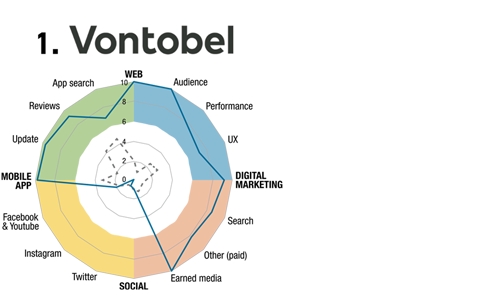

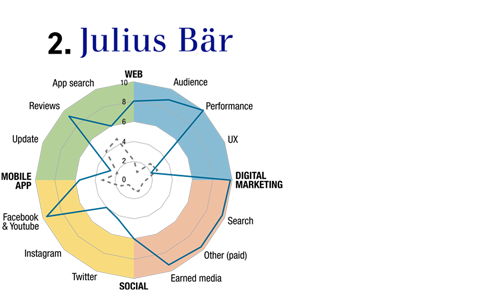

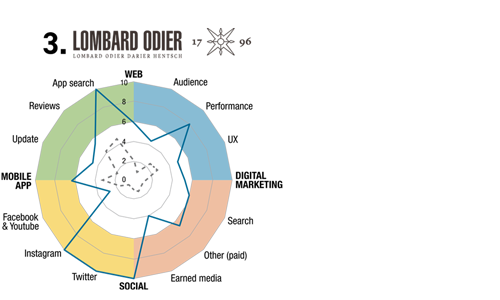

The consultancy added that three Swiss private banks dominated the rankings: Vontobel, Julius Baer and Lombard Odier.

Zurich-based Vontobel had a strong reputation in all matters digital and had launched various apps and tools over the last few years. The bank also knew how to boost its web presence, including in marketing, and stood out for its consistently up-to-date digital services (see graphic).

The study stressed that the private banks had a long way to go to catch up with universal banks on digitizing their customer relations services. «In many cases, they are dealing with tactical initiatives. This is certainly due to the fact that the players are facing the challenge of trying to translate the current private banking world into a digital form rather than trying to reinvent it. This usually results in timid and slow-to-act approaches.»

Second-placed Bank Julius Baer used digital marketing the most intensively and, in contrast to the other banks, had an above-average presence on popular social media such as Facebook or YouTube. In general the Zurich-based bank came across well on the web, with its content having a strong impact thanks to its powerful web presence (see graphic).

Geneva-based Lombard Odier had a generally good web presence, particularly through its above-average engagement on social media such as Instagram and Twitter. The app came out well due to its user-friendliness and breadth of content. The consultants said this fitted in with Lombard Odier's claim to be a sustainability-oriented bank, which mainly appealed to a younger clientele (millennials, Gen Z, Next Gen) (see graphic).

The 29 private banks studied were: Bergos, Baumann, BNP Paribas, Bonhôte, Bordier, Compagnie Bancaire Helvétique, Cramer, Edmond de Rothschild, EFG International, Gonet, Hinduja Bank, Hyposwiss, Intesa San Paolo, Julius Baer, Landolt, Lombard Odier, Maerki & Baumann, Millenium, Mirabaud, Piguet Galland, Pictet, Reyl, Rahn+Bodmer, J. Safra Sarasin, Société Générale, Syz, Thaler, Union Bancaire Privée and Vontobel.