An ominous trend is emerging in Swiss banking – gross earnings are falling and IT costs are rising, a study shows.

The financial benefits to Swiss banks of digitization have yet to materialize, a study published Wednesday by the Itopia consultancy (in German) shows.

Banks had steadily raised their IT costs per employee and customer over the past few years, the study, based on data for 2020 and budgets for 2021 from 26 retail and 11 private banks in Switzerland, said. Over the last year there had been signs of a slight rise in productivity, but there had been an increase in head count at most of the banks.

As a result, the impact of digitization remained below expectations. However, time was growing short for efficiency gains if the trend of falling gross earnings per employee, which had emerged since 2017 in both retail and private banking, continued.

Itopia added that were the growth trend in headcount to continue it would be the opposite of the effect expected from digitization.

Challenge Greater for Private Banks

The study said private banks faced greater challenges reaping the benefits of digitization. The fall in revenues at private banks since 2017 was significantly higher than at retail banks at 13.1 percent compared with 10.5 percent.

At the same time IT spending per active customer at private banks was also much higher than at retail banks. Retail banks’ IT costs ranged between 57 and 250 Swiss francs ($63-$278) per client, with one exception of 452 francs, resulting in a mean of 169 francs.

Risk of Doing Nothing

At private banks these costs varied between 475 and 4,314 francs (with an exception of 6,648 francs), making the mean of 1,628 francs almost ten times that of retail banking. However, private banks’ revenues per customer at a median of 16,953 francs were many times those of retail banks’ 1,464 francs, the study showed.

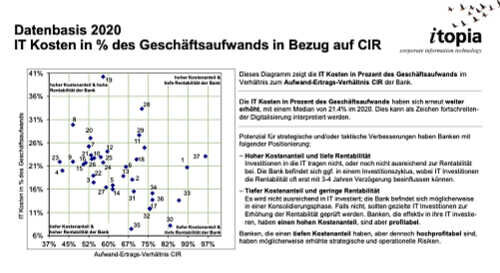

Itopia also found outliers. Many had consistently low IT costs and stood out because of their strong profitability. However, the consultancy said that such a model might harbor greater, strategic risks.

Four-Year Delay

It said that the opposite scenario, where a bank’s profitability was low despite high spending on IT, might be a sign that the bank was in an investment cycle. Its IT investment would pay off in terms of efficiency and profitability three-to-four years down the line.

However, if a bank spent a lot on IT and the benefits did not materialize in the medium term it would be a sign that the budget had seeped into the wrong areas and needed to be used in a more targeted way, Itopia said.