Branch closures, banking consolidation, even liquidation. No stone will be left unturned in Europe's retail banking sector in the next two years. What about Switzerland?

The neighborhood bank managed to get through the 2020 pandemic largely unruffled. That is what most Swiss retail bank annual reports say. The same holds true in other European countries, according to a PricewaterhouseCoopers (PWC) study comprising 50 institutes with 690 million clients in 15 countries.

The study, which includes the five leading Swiss institutions, provides some surprises.

Profit fell at some retail banks by as much as 40 percent while credit loss provisions on average more than doubled. Revenues, their lifeblood, fell less than feared, according to Andreas Pratz, author of the study and partner at PWC unit Strategy& as well as Marcel Tschanz, partner and Head Banking Advisory PWC Switzerland, in a talk with finews.com.

Government Steps In

«We were surprised at how well European retail banking did in 2020,», they said. «We had forecast revenues falling an additional 9 percent. In real terms, revenues were only down 4.5 percent.»

«Retail banking benefited from government emergency programs, which helped to save many companies and jobs,», the PWC experts said.

Start of a Dry Spell

Last year, however, was a turning point that will result in massive changes in the European retail banking sector over the next two years, with PWC reckoning that 40 percent of all branches will disappear.

Part of the reason for that is changing client behaviour, which has shifted farther to digital channels following the pandemic. But declining earnings, which fell faster than costs, will also have an impact, signaling the start of a dry spell. The large expense of recent restructuring measures in the industry will pressure revenues until 2023.

The Swiss Exception?

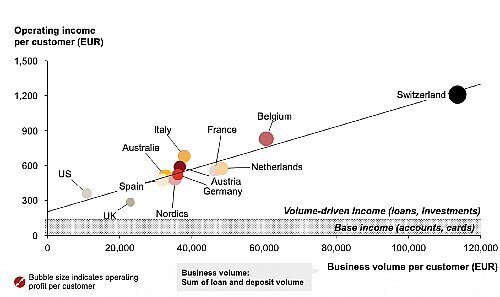

Swiss banking looks like it will be the exception to the rule, and looks like it is in a comfortable situation, even though UBS is closing one of every six retail branches and Credit Suisse is cutting its network by about a quarter, the PWC experts believe.

«Swiss banks profit from very high revenues of 1,200 euros per client ($1,461)», they calculated, although this is due to the fact that the higher volumes are generated from high individual client debt in the mortgage business. Given the Swiss rarely pay down that debt for tax reasons, this guarantees a steady source of revenues for banks. It is also positive that Swiss retail banks managed to digitalize their business early. Because of all that, the pressure to consolidate is not as urgent in Switzerland, the PWC experts said.