Covid-19 vaulted digital banking to new heights and its growth continues. Recent data shows startups are grabbing niches and focusing on women as clients.

The Swiss government has loosened pandemic measures, but the pivot to digital channels that it sparked last year is here to stay. Long-established credit management company Intrum, for example, registered 150,000 client onboardings in Switzerland using its third party video identification product, it told finews.com.

According to Intrum, clients that use it typically see new account openings afterwards and the number of times it has been used grew again by half this year alone.

Gold Rush Ahead

The surge seems to portend a veritable gold rush for banking apps and digital wealth managers. Newly-launched Yuh, a Postfinance and Swissquote project, has registered 10,000 users. And UBS hopes to win $30 billion in digital mandates for its My Way offering in the next 12 months.

And impact investing app Yova just received 11 million Swiss francs ($12.2 million) to fund its expansion, in part, to Germany.

Half of the Market

Yova is emblematic of a wider trend that appears to be accelerating. Neobanks and digital wealth managers are no longer looking for market breadth in order to reach scale. Instead, they are focusing on dominating niches.

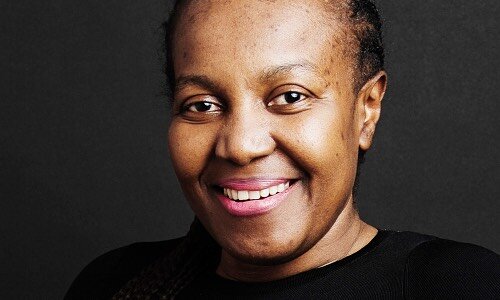

Fea Money, for example, has positioned itself as the first digital offering exclusively for women. Founded and run by Angelyne Larcher (pictured below), Fea wants to reach this «community» – who make for half of the market – with customized financial products and investment options.

Bank, Network and Venture Capital in One

Not just that. Larcher told finews.com that the app's offerings, which are being readied for August, include the provision of financial expertise and a network allowing clients to exchange views and experiences in the finance sphere. And a portion of its revenue will be used to support aspiring female entrepreneurs.

She partnered with Hypothekarbank Lenzburg, which also works with Swiss digital banking pioneer Neon. Larcher also intends to get a fintech license to help the business expand into Europe in upcoming years.

Sustainable Retirement

Digital banking has made headway in other areas such as sustainable investments. Neon, which recently reported it had 70,000 users, is working together with Yova. The Basel-Land Cantonal Bank is working with a sustainably focused digital bank. And when Geneva's Reyl digital unit Alpian starts, it will include impact investment funds from Asteria, another Reyl unit.

Digital providers are also competing for retirement funds (German only). Many apps and on-line platforms, following in the tracks of VZ, Viac and Selma Finance, have discovered the roughly $130 billion large business in private sector retirement fund. This effort includes larger institutions such as Zurich Kantonalbank, with its Frankly app.

Giants Challenged

This current drive shows that neo and digital banking is here to stay. It also shows that the market is maturing. And at the moment it looks like there is still enough room for a long line of providers. Overseas giants such as UK's Revolut and Germany's N26 are also on the starting blocks in Switzerland but they do not dominate the business, at least not yet.

A report by Intrum confirms the trend. Domestic finance apps such as Neon, Yova and Selma are seeing strong demand. Neon itself wants to have 120,000 clients by the end of the year, almost double today's number.