Credit Suisse’s new head of IT, Joanne Hannaford, is the first top manager to have been appointed in an orderly process for a long time, and Chairman António Horta-Osório is keeping his eye on the others.

The appointment of Joanne Hannaford is to drive Credit Suisse’s digital transformation as chief technology and operations officer could be a first hint of new chairman, António Horta-Osório’s, plans for Credit Suisse.

Limbo for Staff, Top Management

In an interview with the «Neue Zuercher Zeitung» (in German, behind paywall) last week he made it clear that he wanted to transform the bank, with risk management and corporate culture at the top of the list.

However, the urgent need to do so after the Greensill and Archegos debacles cost the bank billions contrasts with his timetable. He intends to take until the end of the year to draw up a new strategy, leaving the banks’ 47,000 employees as well as its top management in the dark about their immediate future.

Strategic Appointment

In the press release Horta-Osório said Hannaford, who was a partner and technology manager at Goldman Sachs for many years, was «well positioned to lead our strategic efforts going forward».

Horta-Osório had little to do with Hannaford’s recruitment. She was lined up long before he took office two months ago with the aim of bringing digitization and technological developments, which have become highly relevant in the financial services industry, to the top table. However, her appointment could be a sign where he wants to take Credit Suisse.

Who Will Be «Right People»?

It was clear also from the NZZ interview that not just the «how» but also the «who» is important to Horta-Osório. Long-term success would only come about when «the right people are in the right places and work as a team», he said.

This statement takes on a new meaning in the context of Hannaford’s appointment. The new chairman is keeping a beady eye on the top management team.

Revolving Door

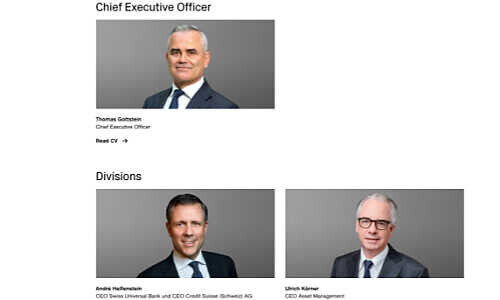

It cannot have escaped Horta-Osório’s attention that the bank’s board of management has been a revolving door over the past two years. Six of the 12 members of the board, including CEO Thomas Gottstein, have gained their posts due to unexpected developments.

International Wealth-Management CEO Philipp Wehle took over from Iqbal Khan in July 2019 after his abrupt departure for UBS. Gottstein succeeded Tidjane Thiam in February 2020 after the «Spygate» scandal made his position untenable. André Helfenstein then moved up to become head of the Swiss universal bank. Ulrich Koerner was brought in in April as CEO of the battered Asset Management unit.

Chance Rather Than Design

Joachim «Joe» Oechslin had to act as head of risk when the Greensill and Archegos affairs brought down Lara Warner. Christian Meissner had barely been six months at Credit Suisse when he was promoted to head of the investment bank because Brian Chin shared some of the responsibility for the billions lost in the wake of hedge fund Archegos’ collapse.

All of this means the bank’s current management gives the impression that it has to a certain extent been thrown together by chance or is the result of events that a bank like Credit Suisse would have done better to avoid.

Transformation Rather Than Sale

In his two months as Credit Suisse chairman, Horta-Osório has given the deliberate impression of being an experienced manager who likes to get to the bottom of things before making decisions in his cautious statements on the potential solutions to the crisis at Credit Suisse.

His record at U.K.-based bank Lloyds, which was fighting for its survival when Horta-Osório took over as CEO, shows that he prefers internal change to sell-offs and wholesale restructuring.

One thing he will have noticed since he took over at Credit Suisse is that Switzerland’s second-largest bank has not made any progress for years. While looking into the reasons, Horta-Osório will place the management under the microscope, determine who bears what responsibility and draw the appropriate conclusions.