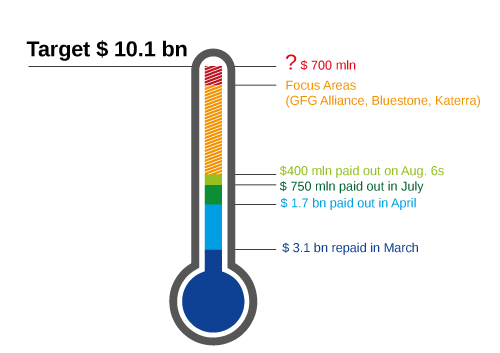

Credit Suisse's CEO Thomas Gottstein says his top priority is recovering investors' stakes in the Greensill supply chain funds. He still has a substantial amount of money to collect – and it might not be that easy.

Most of the remaining third of the $10.1 billion owed to investors and yet to be recovered is tied up with three companies, known as the focus areas: Metals magnate Sanjeev Gupta's GFG Alliance, metallurgical coal company Bluestone Inc. which belongs to the governor of the U.S. state of West Virginia, Jim Justice, and Katerra, a construction startup which filed for protection from its creditors in June.

Both GFG Alliance and Justice are also involved in disputes with other creditors, making the task of recovery even more difficult.

Another avenue of recovery mentioned has been the insurance on the loans Greensill Capital made, but its validity has been called into doubt.

The loss of client's investments in the Greensill funds has shredded Credit Suisse's reputation, which be all the more difficult to restore if the bank is unable to return a substantial chunk of the money.