Wealth management has traditionally been the trump card of Swiss finance. But the field has also been the hotbed of any number of innovations over the last fifty years that have had a far-reaching impact across the industry. The individuals behind them have been visionary in their ability to recognize developments early and build franchises from them. finews.com showcases ten key innovators below.

1. Matthias Reinhart: The «independent» advisor

He founded VZ VersicherungsZentrum (direct translation: VZ InsuranceCenter) in 1993 with Max Bolanz, deceased in 2001. Their objective was to bring pricing and service transparency to Swiss banking and insurance. It started as a way of brokering insurance contracts but it expanded its offering in 1997 when it changed its name to VZ VermögensZentrum (direct translation: VZ WealthCenter). The basic idea was to offer independent advice while clearly separating themselves from product sellers.

As time passed, the business started advising on pensions, inheritance, thematic investments and taxes. It made a reputation by becoming the focal point in Switzerland for financial issues, becoming a counterweight to the major Swiss banks. That helped the company become such a success that it went public in 2007. Today it employs about 1,200 people and manages more than $32.5 billion in client assets. Reinhart holds about 60 percent of the company. Swiss magazine «Bilanz» estimates Reinhart's wealth is about $2.7 billion.

2. Urs Wietlisbach, Alfred Gantner, Marcel Erni: Private Equity Investing

Alfred Gantner, Marcel Erni und Urs Wietlisbach worked at Goldman Sachs before starting Partners Group together in 1996. They recognized the lucrative niche of private equity investments, which traditionally have little correlation with equities and the needs of retirement funds and insurers. With that, the Zug-based company quickly gained a reputation as an investment specialist for private equity.

They IPOed in 2006 and thanks to their highly focused business model they managed to become one of the largest success stories in the history of Swiss finance. It is still a model for others, even overseas, and it is now internationally active, being able to count the Norwegian sovereign fund as one of its clients. As recently announced, the group is investing in a new headquarters in Baar in Central Switzerland, which will be a three-building campus.

3. Martin Ebner: the «Aktiensparer»

Martin Ebner worked at Bank Vontobel before becoming independent in 1985 to found BZ Bank. He was visionary in his ability to see that corporate pension funds needed additional investment opportunities for the massive sums from federally mandated employee contributions after the introduction of a new Swiss law in the same year he became independent. He managed it by writing options and creating investment holding companies he called «visions».

During the 1990s boom in equities, he created the term «Aktiensparen» in Switzerland, which can be roughly translated as «equity-saving». He was influential in helping the Swiss put an increasing amount of their money into equities over the years. Although he lost a substantial portion of his wealth in the 2001-2002 financial market turbulence, he made an almost unbelievable comeback afterward, establishing himself as a highly talented investor who developed a flair for charter airlines, with even the pandemic not having much of an impact on him or Helvetic Airways, which he owns.

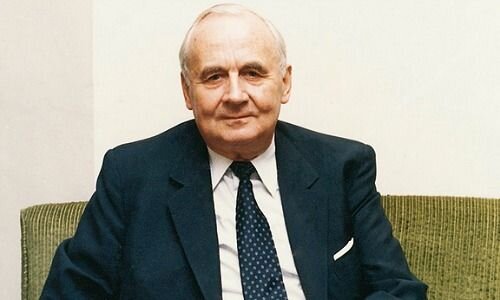

4. Robert Holzach: The Educator

The legendary Union Bank of Switzerland (UBS) doyen Robert Holzach (1922-2009) recognized as one of the first bankers the importance of life-long learning in the financial industry. He started UBS's education center in Schloss Wolfsberg in the 1970s and it is still where future managers go for training before assuming positions of higher responsibility.

In Holzach's day, courses were not your average classroom fare but provided a mix of specialist training, management theory and holistic education, as Holzach himself formulated it. It was provided in courses and discussions – sometimes even through role-acting and theatrical scenes, such as how an executive should parry with a tabloid or deal with a protester in front of a bank branch. Wolfsberg also provided an array of social events, allowing UBS managers to meet with personalities in business, politics and culture. And if you weren't called up to go to Wolfsberg at the former Union Bank of Switzerland (UBS), it meant you had no career there.

5. Marc Bürki: the Digital Trader

Many recognized the potential of online banking in the 1990s but Marc Bürki, who was a telecommunications specialist, created a business model in 1997 that has stood the test of time more so than any other in Switzerland. He persevered through the bursting of the dot-com bubble in 2001, when many others gave up, making Swissquote the leading Swiss online bank.

He IPOed in 2000 and received a Federal Banking Commission (now Finma) bank license. He and co-founder Paolo Buzzi are uncontestably the number one in the country. They have been astutely managed the shift towards digital assets and are also profiting from the boom in that area. They are currently so successful that they regularly surpass publicly stated earnings targets.

6. Edgar de Picciotto: the Hedge Fund Pioneer

Born in Lebanon of Jewish heritage, Edgar de Picciotto (1929-2016) first studied engineering before escaping with his family from Beirut to Switzerland through Italy in the 1950s. In 1955 he arrived in Geneva, where he «married into» the family owning Société Bancaire de Genève. In 1969 he established the Compagnie de Banque et d'Investissement (CBI), with which he took over the significantly larger Trade Development Bank – American Express Bank (TDB) in 1990.

From that, today's Union Bancaire Privée UBP) was created. De Picciotto, who became Swiss in 1972, was one of the first in Swiss finance who recognized – together with investor George Soros – the potential of hedge funds, making a series of highly successful investments in them. That made him a pioneer – and a billionaire. Despite that, UBP was deeply impacted by the Bernard Madoff scandal and its reputation took a severe hit. He was forced to take back the operative reins of the bank at 80, bringing him back on course. He died in 2016 at 87.

7. Jan Schoch: Structured Products Trailblazer

Structured financial products have been around a long time. But it was Jan Schoch, from Appenzell, that propelled them to a breakthrough in Switzerland. He had worked for J.P. Morgan, Goldman Sachs and Lehman Brothers, making a name for himself as a derivative specialist. But he rejected the safety of a career at a major bank to start EFG Financial Products with a few partners in 2007, which was later renamed Leonteq after going public in 2012.

Schoch focused on developing and distributing structured products more than anyone else in Switzerland, products that became increasingly popular after the 2007-8 financial crisis. That helped Schoch and his partners financially although he could not manage the high investor expectations. Leonteq shares crashed and Schoch was kicked out of his own company. After a pause to rethink and recharge, he is back as a hotelier, investor – and financial entrepreneur with a new company.

8. Marianne Wildi: the Open-Banking Architect

Marianne Wildi joined Hypothekarbank «Hypi» Lenzburg in 1984, working in information technology. Between 2007 and 2017 she was head of services, IT and logistics, being appointed chief executive in 2010. Under Wildi's management, the firm developed into a bank that used an open-banking strategy to differentiate itself. Wildi is convinced that open platforms will become increasingly important in banking in the future. Her vision is to create an entire eco-system with her proprietary Finstar banking software using open interfaces, or so-called open application programming interfaces (APIs).

Various fintechs and other service providers have since docked with Finstar, and can now exchange bank data, creating the first open bank platform in Switzerland. Her decision to allow blockchain and cryptocurrency providers in Switzerland direct account connections had a large impact in Switzerland and abroad.

9. Guy Monson: the First Sustainable Investor

Sustainable investing seems to be everywhere now. That wasn't always the case. In fact, the opposite was – and it took a very long time to bring it to where it is today. Basel private bank Sarasin (today J. Safra Sarasin) was a pioneer in the area after it started concentrating on sustainable investments in the latter half of the 1980s. It was in reaction to the Chernobyl nuclear disaster and the large-scale fire at the Schweizerhalle chemical storehouse, when pollutants turned the Rhine red, both events happening in 1986.

The driving force behind it all was investment specialist Guy Monson, who then recognized the value of sustainable investment strategies. With that, he and the Rhine-based bank have been able to differentiate themselves to this day in that area. Monson, who now has more than 35 years of investment experience, is now Chief Investment Officer and Senior Partner at Sarasin & Partners LLP, a limited liability partnership based in London. He is heading the global investment and marketing strategy of the firm for a large number of charities, foundations and private clients.

10. Vitalik Buterin: the Crypto Wunderkind

The only 27-year-old Canadian-Russian software developer Vitalik Buterin is a global nomad in the truest sense. But it was his time in Switzerland, Zug specifically, that was the most decisive for him and the industry. He created the blockchain network Ethereum in 2014 with a number of like-minded partners, creating Ether, one of the world's main cryptocurrencies. Ethereum is for many the most promising blockchain project because of the almost infinite ways it can be used.

The platform is currently profiting from so-called Non-Fungible Tokens (NFT). But it can be used for digital art objects such as images, photographs or 3-dimensional models by given each certificate, making each one a unique artifact. For buyers, that is a guarantee that they are getting something authentic. In 2017 Buterin moved to Singapore. In 2018 he was given an honorary doctorate by the University of Basel. According to the university, he received the honor «in recognition of his contribution to promoting decentralization and equal rights of participation in the digital revolution, as well as for his achievements in relation to cryptocurrencies, smart contracts, and institutional design.»