They are falling out of favor, with research by finews.com showing that numbers have been falling for years. A sector's new reality.

When Philipp Rickenbacher takes to the floor on Thursday to discuss Julius Baer's strategy, many will be listening very closely to what the CEO has to say about client-facing staff. Since taking over the bank in 2019, he has exerted surprising pressure on private bankers, who previously roamed the bank as if it was their fiefdom. He instituted a job-cutting program in 2020 that has replaced dozens of front-liners.

More with Less

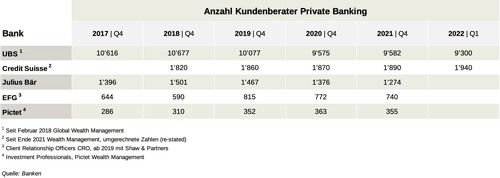

Since then, the number of client advisors at the long-established Swiss bank has been falling continuously (see table below). At its peak in 2018, Julius Baer could count on 1,051 bankers. Now, three years later, about one in six of them are gone.

Rickenbacher's efforts have paid off, until now. As the 2021 record performance shows, the remaining bankers have more assets under them and are more productive. The CEO has found a formula that works.

Difficult Times

Will this strategy continue? Julius Baer did not want to comment before presenting its growth plans for the next few years. According to them, they have not been seeing a high level of fluctuation among their client advisors, with the rate being the same as it was a year earlier.

The world's largest wealth manager – UBS – emphasized, when asked, that it still has a clear growth focus for the business, particularly in the context of the current, difficult environment.

«This requires good customer advisors», a spokesperson indicated.

But the picture it shows is a stark one as it has far less client advisors than it did just a few years ago.

.

Using Natural Fluctuation

The updated historical time series (seventh item on the right-hand column) released when first-quarter numbers were disclosed at the end of April shows that the world’s largest wealth manager had 9,300 advisors in its Global Wealth Management business.

That is more than four times the number that Credit Suisse has but it is still 1,377 less than the number it had when creating the new Global Wealth Management division in 2018.

Apart from isolated dips, the number has been declining steadily. The updated historical time series (seventh item on the right-hand column) released when first-quarter numbers were disclosed at the end of April shows Asia has been hit the hardest, with 17 percent fewer advisors now than at the end of 2019. In Europe, the Middle East, and Africa (EMEA) the numbers have fallen 11 percent to 1,472. In the Americas and Switzerland, they are both down by about 5 percent at 6,199 and 686 respectively.

The UBS spokesperson maintained there had been no redundancies or restructuring when managing the levels lower and that they were simply taken down through normal fluctuation - voluntary resignation, retirement, transfers, and similar.

The Impact of Digitalization

When the global market leader needs less bankers, that is significant. Even more so in that the average revenues per advisor are up 4 percent year-on-year, seemingly indicating a similar finding to that made by Julius Baer.

So, what gives? According to the UBS spokesperson, the decline relates to increased productivity from the impact of new technology and process digitalization. A UBS program called Client Time helps advisors save up to 30 minutes a day in administrative burdens by making processes less manual and less complicated.

Although UBS is going all-in on assuming technological leadership in the sector under CEO Ralph Hamers, Zurich private bank EFG International is all about people. Its business model requires it. Their so-called Client Relationship Officers (CRO) are the backbone of the institution, but their numbers have also been falling for the past three years.

Credit Suisse Steadies the Ship

Even though EFG is still in the hunt for a capable CRO, it apparently has managed to increase the assets managed per advisor by almost half (42 percent) since 2018. And 2021 has turned out just fine by the looks of it.

The same can't be said for Credit Suisse. Its Wealth Management division was also impacted by a series of external and internal debacles. Taking stock of the last four years (based on the current structure) shows that client-advisor numbers have remained stable. Despite the heavy turbulence and various restructuring steps taken - at least that is what it looks like.

According to Credit Suisse, the actual number of advisors is up as different units were integrated into the Wealth Management division. It also managed to replace departing employees. In the first quarter of 2022, the number or advisors in wealth management even increased.

Pictet has Space

The trend at the Geneva-based private bank is clearly upward. It has created roughly a quarter of new jobs in the wealth management business in the past five years. Its new office in Zurich has space for another 100 as yet unfilled jobs, a step that can be taken as a clear sign for the industry. It wants to expand right under the noses of the two main banks. And its new headquarters by the Rhone will have space for 3,000 employees in a 54,000 square meter office.

Just up the street, the Zurich Cantonalbank (ZKB) is also hiring more front-line staff. «The demand for more complex advisory services has generally risen», a spokesperson indicated. «We see a great deal of potential in this segment and that is why we are systematically expanding it.»

Since 2017, it has increased advisor capacity by about 10 percent although a bank spokesperson refused to disclose concrete numbers although they are likely to have about 100 advisors on hand in private banking.

In the Wrong Place

The expansion underlines ZKB's ambition of taking up a leading role in private banking. That is also why the business is now under the leadership of Florence Schnydrig Moser, who was previously at Credit Suisse executive.

Private Bankers moving out of the main banks can still find a home. But the rising productivity and client portfolio requirements is making wholesale shifts increasingly hard. The head of one of the larger private banks in Zurich confirmed that confidentially. «A young banker with shining eyes saying he can bring in 50 million Swiss francs in assets is unfortunately in the wrong place with us.»

Additional reporting and assistance: Andrew Isbester, Roger Sandmeier (table graphics)