The takeover of Credit Suisse by UBS is shaking up the market shares of Swiss fund providers. Smaller players could benefit more than the market's number one.

According to the fund market statistics of the Swiss Asset Management Association (AMAS), shifts in market shares of Swiss fund providers have taken place in the first quarter.

With the takeover of Credit Suisse by UBS in progress, the market structure will change significantly, the association predicts. Admittedly, the ranking is currently still unchanged, although Credit Suisse's market share declined significantly.

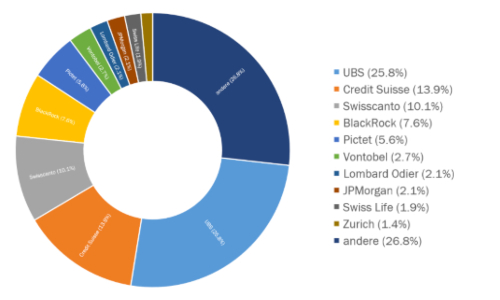

UBS, the undisputed number one in the Swiss fund market, was only able to increase its share marginally. Clear gains can be seen at Swisscanto, Blackrock, and Pictet, the third to fifth largest providers in the market (chart below).

For example, Credit Suisse's market share fell to 13.9 percent in the first quarter from 14.3 percent in 2022, according to AMAS statistics, while UBS's rose marginally to 25.8 from 25.7 percent for the corresponding periods. Taken together, the big banks account for just under 40 percent of the market.

But the pursuers are closing in. Last year, the next three largest fund providers made gains, with Swisscanto improving to 10.1 percent from 9.5 percent last year, Blackrock to 7.6 from 7.4 percent, and Pictet to 5.6 from 5.5 percent.

In Search of Returns

In terms of volumes, the Swiss fund market benefited in the first quarter from falling inflation concerns and a rising risk appetite among investors. In the search for yield, there was increased investment not only in equity funds but also in money market funds. «Inflation fears in the market have subsided, leading to a resurgence in investor confidence despite the turmoil in the financial industry,» says AMAS CEO Adrian Schatzmann.

The assets of the investment funds included in the statistics totaled around 1.37 trillion Swiss francs at the end of March, up from around 1.32 trillion at the end of 2022, representing an increase of 48.1 billion Swiss francs or 3.6 percent.

Best Performing Equity Funds

Equity funds achieved a positive performance of 5.7 percent in the quarter and recorded the largest inflows with 6.2 billion Swiss francs. Money market funds attracted 3.7 billion with a performance gain of 0.6 percent, while bond funds saw inflows of 2.1 billion Swiss francs and a positive performance of 1.6 percent.

On the flip side, investment strategy funds were down 1.4 percent, alternative investments fell one percent, and real estate funds registered a 0.8 percent decline, with all funds recording outflows.

The fund market statistics data are collected by Swiss Fund Data and Morningstar.