On Monday, the takeover of Credit Suisse becomes official from whence UBS will call the shots. A separate path for the Swiss business of the soon-to-be-extinct bank now also seems very unlikely.

On Monday, CEO Sergio Ermotti can finally pull out all the stops. With the delisting of Credit Suisse shares, the takeover by «his» UBS is complete, leaving only the UBS Group.

Waiting is the Hardest Part

With the integration, the waiting game on both sides of the merger ends. Due to regulatory requirements, UBS management at Credit Suisse was only allowed to take limited action. Now it can directly instruct Credit Suisse employees to start integration and downsizing work and persuade clients looking to switch to another bank to stay. When the integration is completed at the end of 2027, the combined entity aims to have saved around $8 billion in costs, of which $6 billion will be personnel.

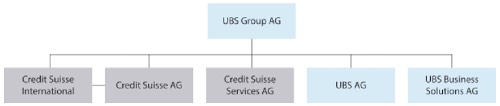

The integration pace will remain uptempo, Ermotti stressed at a conference last week, saying there is limited time for analysis and that implementation has to be fast. He also outlined the new power structure, with UBS alone at the top of the pyramid. Contrary to earlier promises, Ermotti installed almost exclusively UBS employees in the new management team. He did so with the argument that he couldn't risk managerial experiments at this stage.

He underlined that by saying «This is an acquisition, not a merger.»

(Graphic: UBS / SEC-Filings)

Examining all Options

While it was clear from the outset the Credit Suisse brand would disappear abroad, many in Switzerland, including politicians, hoped for the bank's continued existence in its home market. The chances of this have diminished significantly.

Publicly, UBS is saying all options are being considered for the Swiss unit of Credit Suisse. At the same time, the head of UBS said the integration of Credit Suisse Switzerland is the basic scenario for the takeover, and to sharpen the point that there is no need for two big banks in Switzerland.

Spin-off is no Panacea

This isn't a good omen for Credit Suisse's continued existence in its home market, where the bank can look back on a 166-year tradition. What's more, the idea of a spin-off of the Swiss Bank unit has lost quite a bit of luster. In theory, such a move would have preserved a substantial number of jobs in Switzerland, and competition law measures of a new megabank would not have kicked in. At the same time, UBS would have booked ten billion francs from the sale of Credit Suisse Switzerland.

In practice, UBS settled on either integrating or winding down Credit Suisse's international business. Whether investment banking, wealth management, or corporate banking, an independent Credit Suisse in Switzerland would be left without international connections. It would be losing much of its appeal, essentially creating another large domestic bank similar to Zuercher Cantonal Bank (ZKB).

Approved is Approved

The question remains whether competition law could be used to force Credit Suisse Switzerland to survive, at least in the medium term. In this context, finews.com analyzed the procedure the Competition Commission (Comco) prescribed for the retail giant Migros when it took over the discounter Denner in 2007.

But a different course was set on March 19 with the government-mandated takeover of Credit Suisse where creditor protection was weighted higher than competition law. «Due to the accentuated emergency, the authorities judged the merger with UBS to be the target-oriented solution to protect bank creditors, the Swiss economy, and the Swiss financial system and to counter the crisis of confidence,» a Finma spokesman said.

With this argument, Finma approved the merger ahead of schedule on March 19.

Withdrawal Would Jeopardize Merger

Even if it is only beginning to dawn on many observers, the transaction is now a done deal. Finma is in contact with Comco and will examine the antitrust aspects, and is still responsible for applying the Cartel Act in the UBS-CS case. For the regulator to partially reverse the integration after the merger has already been approved would likely constitute a gross violation of the agreement reached with UBS, jeopardizing the entire deal.

Finma has proven it's willing to go far to ensure the takeover's success. Imposing the write-off of Credit mandatory convertible bonds, which has brought Finma hundreds of lawsuits, is one example. It has accommodated UBS by giving it until the end of 2029 to meet all the new capital adequacy requirements.

No Happy Ending

With this in mind, Ermotti is free to keep the choice cuts of Credit Suisse Switzerland. These include corporate banking, the pension fund business, private banking at UBS while jettisoning branches, and back-office services. The only thing he has to worry about is client behavior.

Ermotti said it's likely some Credit Suisse clients are considering risk concentration, and might want to move their Credit Suisse assets elsewhere, but is promising that UBS is doing everything possible to make clients «happy.»

The end, which is becoming increasingly clear for Credit Suisse in Switzerland as Monday approaches, is not likely to be so happy.