The aging population is a megatrend forcing us to rethink a number of norms. Robotics is one field where the unfolding of innovations and investment opportunities happens.

There is a surprisingly strong correlation between aging and robotics. It turns out that countries with a young population tend to have few robots, while countries with an older population show a much higher number of robots per number of inhabitants (Daron Acemoglu, MIT Economics, July 2018).

Two of the countries with the highest density in robots are Japan and Germany, both of which have among the oldest workforces in the world. In contrast, Britain and France, both of which are aging more slowly compared other developed countries, are much less advanced in their adoption of robots.

Robots Replace Human Labour

There are two reasons for which robots come in handy in an older population. The first reason is simply that robots can replace human labor. In many developed countries, the number of retirees is growing up to three times faster than the number of younger people.

It does not help that the baby boomer generation born in the twenty years following the end of World War 2 is roughly twice as numerous as the generations before or after them. Replacing them is no easy feat, on both numbers and skills, and tends to pave the way for automation and the rise of industrial robots – handling pellets, welding machine parts or assembling cars. The second reason is that a growing number of older people creates entirely new markets for a wide range of new robots.

Japan as a Think-Tank

Take Japan, the oldest nation in the world, where there are already not enough young people today to care for a growing number of elderly. For the first time last year, the country counted one person over the age of 70 for every five inhabitants.

Meanwhile, the average age of caretakers in a hospital, nursing home or home setting is approaching their mid-40s, many of them having an increasingly hard time lifting frail and sometimes heavy patients out of bed and into a bathtub or a wheelchair.

Wide-Eyed Little Fantasy Robot

This is why several companies are developing so-called exoskeletons, full-body suits of electronic muscle that can assist, amplify and sometimes even anticipate a human’s movement. The next step being, of course, to give the task over to a machine entirely. In fact, roughly one in ten nursing homes in Japan is already employing simple robotic lifting systems.

This being Japan, the most popular lifting robot looks like a giant teddy bear and is called «Robear». And «Robear» is not alone. Robot dogs like Sony’s Aibo, first launched twenty years ago and just face-lifted for the umpteenth time, is increasingly popular to provide companionship to patients with memory loss, as are its pals Paro, a furry seal, and «Buddy», a wide-eyed little fantasy robot.

Innovating in Order to Reduce Cost

As investors, we are looking for companies that have staying power over the long run. High-quality companies who are good stewards of capital. Companies who are good citizens, in that they show respect for all their stakeholders. And companies who have come up with ideas and actions to meet some of the challenges associated with megatrends such as an aging population.

One of the key challenges that our societies face is the rising burden of healthcare cost that comes with a higher incidence of dependence and costly age-related conditions such as cancer, cardiovascular disease, diabetes, and dementia. And while many investors cast healthcare as a sector that stands to benefit from an aging population and rising patient numbers, we think that is too simplistic.

Inviting Robots Into Humans’ Daily Lives

In fact, we are convinced that there will be an increasing disparity between the winners and losers within the sector. We think that only those companies able to provide better patient outcomes, improved treatment access and reduce the overall cost for the system will be likely to survive in the medium term.

Japan may be at the forefront in inviting robots into humans’ daily lives, but other countries are likely to follow suit. The aging population megatrend is still in its in early innings. So are the many ways in which technology could play a role in it, helping both to improve the lives of the elderly and to reduce the strain and cost of caring for them.

Beyond Aibo and Paro

We think that new challenges require new solutions and robotics is one field where we see the unfolding of a number of exciting innovations and investment opportunities.

Beyond Aibo and Paro, you might think of other service robots, helping older people stay independent for longer. In people’s own homes, robots can take on chores like vacuum cleaning, washing dishes, helping prepare simple meals or put objects back in their assigned places. Pushing out the age at which someone has to move into a nursing home would score an important win on quality of life and cost at the same time.

More Than Pick Up Crumbs

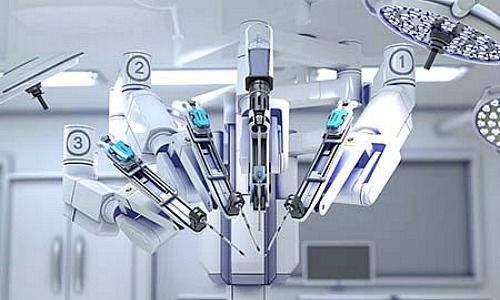

But our little machine helpers can do more than pick up crumbs. Take surgical robots, who are simply better at certain very complex tasks than we humans are. A robot arm tends to have a wider range of motion and dexterity than the human hand. It can make more precise and smaller incisions, leading to minimal invasiveness.

Some robots that have been used for years in general surgery, mostly for procedures in elderly patients, such a resection of the male prostate. With a minimally invasive procedure, the patient is likely to recover more quickly and shorten her hospital stay, saving significant cost.

Young Retirees

Today, robotic systems are also used in orthopedic procedures such as knee or hip replacements, where they improve the reproducibility of the procedure, reduce the error rate and often remove the need for costly revision surgery. And with 70 being the new 50 and today’s young retirees expecting to be more physically active for longer, this requires more complex and flexible implants that a human hand is simply less apt to place reliably.

At Lombard Odier Investment Managers are looking for companies that have staying power over the long run. High-quality companies that create value for themselves and their shareholders. Companies that avoid pitfalls and risks that are tolerated a little less each day, such as treating their employees or the environment with disregard. And companies that have come up with means to meet some of the challenges associated with megatrends such as an aging population.

This document is issued by Lombard Odier Asset Management (Europe) Limited, authorized and regulated by the Financial Conduct Authority (the FCA), and entered on the FCA register with registration number 515393 Lombard Odier Investment Managers (LOIM) is a trade name. This document is provided for informational purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This document does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipients exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. The contents of this document are intended for persons who are sophisticated investment professionals and who are either authorised or regulated to operate in the financial markets or persons who have been vetted by LOIM as having the expertise, experience and knowledge of the investment matters set out in this document and in respect of whom LOIM has received an assurance that they are capable of making their own investment decisions and understanding the risks involved in making investments of the type included in this document or other persons that LOIM has expressly confirmed as being appropriate recipients of this document. If you are not a person falling within the above categories you are kindly asked to either return this document to LOIM or to destroy it and are expressly warned that you must not rely upon its contents or have regard to any of the matters set out in this document in relation to investment matters and must not transmit this document to any other person. This document contains the opinions of LOIM, as at the date of issue. The information and analysis contained herein are based on sources believed to be reliable. However, LOIM does not guarantee the timeliness, accuracy, or completeness of the information contained in this document, nor does it accept any liability for any loss or damage resulting from its use. All information and opinions, as well as the prices indicated, may change without notice. Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income. Source of the figures: Unless otherwise stated, figures are prepared by LOIM. Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources. Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice. No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient, without Lombard Odier Asset Management (Europe) Limited prior consent. In the United Kingdom, this material is a financial promotion and has been approved by Lombard Odier Asset Management (Europe) Limited which is authorized and regulated by the Financial Conduct Authority. ©2019 Lombard Odier IM. All rights reserved.