Asia-Pacific offers numerous risk premia for factor-based investment strategies, which are significantly higher compared with the corresponding factors in other regions.

By Christoph Schon, Executive Director, Applied Research for EMEA at Axioma

Swiss investors, who are looking to get involved in Asia, may be able to find a number of lucrative investment opportunities there. In particular the magnitudes of some risk premia – absolute and risk-adjusted – are above those of comparable factors in other parts of the world. This means that they are particularly suitable for quantitative strategies and smart beta portfolios.

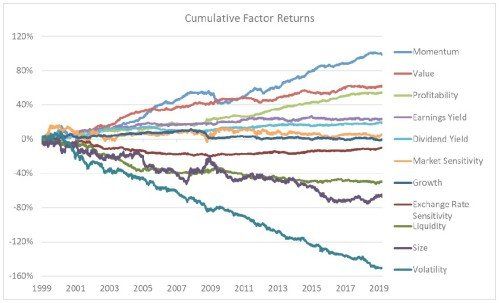

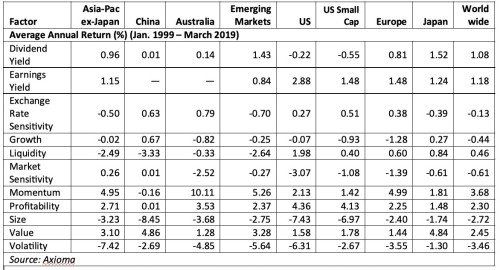

A more in-depth analysis of factor returns over the past 20 years using the new Axioma Asia-Pacific ex-Japan equity risk model reveals that value stocks and those with low volatility and liquidity consistently generated a surplus. Names with reduced market sensitivity (low beta) did not exhibit a notable premium (neither positive nor negative), which was in contrast to most other regions, in which companies that are driven less by the overall market tend to do better.

Low Volatility Pays

Of all examined factors, volatility (followed by momentum) was by far the one with the highest risk premium. The volatility factor is defined in a way that it compares the returns of securities with strong price fluctuations with those of lower variance. Therefore, a negative return indicates that less volatile names fared better than their more variable peers.

This phenomenon could be observed across all regions, but seemed to be most pronounced in Asia, where the average annual premium amounted to 7.4 percent. This compares to corresponding excess returns of 6.3 percent and 3.6 percent in the U.S. and Europe, respectively. Low market sensitivity, which is usually rewarded in other parts of the world, did not add any bonus in Asia.

Twice as Much as in the U.S.

Value stocks in Asia-Pac also outperformed their European and North-American counterparts. The average annual premium was over 3 percent – twice as much as in the U.S. and Europe. Companies with strong profitability (measured as return on capital/assets) did similarly well, earning an only marginally smaller average premium of 2.7 percent.

Stocks with high earnings yield and dividend yield also generated a small excess. Growth stocks, on the other hand, did not show any clear tendency, neither to the upside nor the downside.

Liquidity Comes at a Price

Lower liquidity in any type of asset is usually compensated through a return premium due to the increased risk in a downward market. This is also the case in Asia-Pacific. However, this premium can be difficult to harvest, as illiquid assets, by definition, are difficult and expensive to buy and sell. Therefore, one must consider carefully whether the expected premium of 2.5 percent justifies the significant liquidation risk. Having said that, it also means that holding more liquid securities tends to have an adverse effect on returns.

Similar to buying more liquid names, investing in companies of a bigger size also comes at a price. But it also means that smaller firms should, in turn, exhibit a return premium. This is indeed the case in Asia, although the additional yield is only 3.2 percent per annum – compared with more than double the premium in the United States and China.

Mind the Currency

Special attention needs to be paid to exchange rate sensitivity, which measures the exposure of a company to variations in its local currency against the Special Drawing Rights asset. The cumulative factor return was slightly negative over the whole 20-year period (-0.5 percent per annum), which indicates that exporters (firms with a negative exposure to the factor) did better on average than importers.

However, a closer look at the factor return time series shows that this was only true during the first half of the examined period. After that, the trend reversed and in some years the factor return was even a positive 3.3 percent. Furthermore, the region is made up of a large number of currencies, which are each affected their own individual circumstances.

Attractive Return Premia

In summary it can be said that the Asia-Pacific region offers attractive return premia, in particular to factor-oriented managers and smart beta ETF providers. Low volatility and momentum strategies seemed especially promising. At the same time, investors also need to be aware of the increased liquidity and currency risks prevalent in the region.

For more information please visit Axioma

Christoph Schon, CFA, CIPM, is the Executive Director, Applied Research for EMEA at Axioma, where he generates insights into recent risk trends with a particular focus on fixed income and multi-asset class analysis. He has been in the portfolio risk and performance analysis space for over ten years, having previously worked for Lehman Brothers/Barclays Point and UBS Delta, where he held various roles as Marketer, Head of Client Services and Client-Facing Quant. He started his career in 2000 as a Fixed Income Research Analyst at Dresdner Bank in Frankfurt. He joined Dresdner’s FI index research group in 2002 and served as a member of the iBoxx European technical committee until 2006.