The Swiss franc and confederation bonds are likely to benefit from a deterioration in the EU-U.S. trade relationship, while the local stock market is expected to be hit less hard than the rest of Europe.

By Christoph Schon, Executive Director, Applied Research for EMEA at Axioma

On 15 May 2019, President Donald Trump announced that the decision on whether to impose tariffs on car imports to the U.S. from the EU would be postponed by up to 6 months. Yet, the reprieve is likely to be only temporary, and the threat remains on the table. The special duties of up to 20 percent were first proposed in June 2018.

Since then, both sides have repeatedly signaled their willingness to seek a trade agreement in order to avoid the damaging tariffs, but little progress has been made. In the meantime, the U.S. Commerce Department provided a report to the White House on whether motor vehicles and parts from Europe posed a national security threat for the U.S.

Safe-Haven Status

While specific tariffs on car imports are likely to be most damaging to the German economy with its heavy reliance on the all-important automobile sector, there is also going to be a slight adverse effect on Switzerland, specifically on cyclical industries.

The Swiss franc and confederation bonds, on the other hand, are expected to benefit from their safe-haven status.

Germany Likely to Be Hit Hardest…

We have already had some indications of what a possible impact of a deterioration in EU-U.S. trade relations might be. When the first car tariffs were proposed in the second half of June 2018, the German stock market lost 6 percent within two weeks, with the auto sector being hit twice as hard.

Compare this with a decline of just 3 percent for the overall European market. A 6 percent downward shock for the German DAX index, therefore, seems like a sensible starting point to stress-test such a scenario.

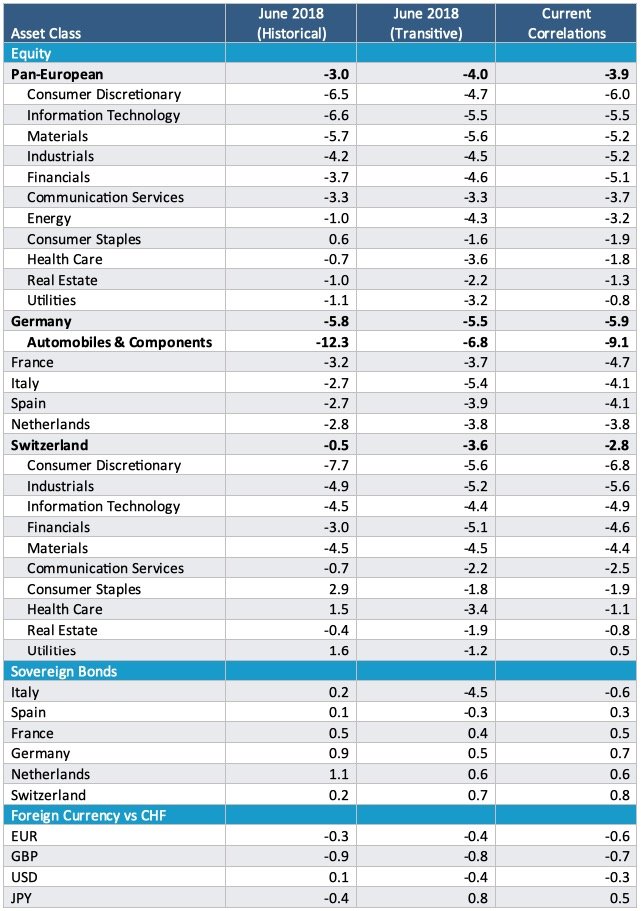

Simulated Returns For Selected Countries And Sectors

(Source: Axioma Risk™)

The table below shows the simulated performance of selected sectors and countries within Axioma’s European multi-asset class model portfolio. The numbers in the second column are based on the actual market movements from mid- to end-June 2018, while the returns in the third and fourth column are derived using a so-called transitive stress test in the Axioma Risk™ portfolio analysis platform.

In the latter two cases, we applied the proposed downward shock to the German stock market benchmark and used correlations from the second quarter of 2018 and the three months to 6 April 2019, respectively, in order to estimate the pricing factor movements for the remainder of the portfolio.

The results seem to confirm the notion that Germany will be among the hardest-hit countries in Europe under such a scenario. Using current correlations, we also note a bigger effect on France, which has had a flurry of negative (economic) news in recent weeks.

…in Particular The All-Important Automobile Sector

The German automobiles and components sector shows an even larger negative performance of -9 percent, although it is less severe than the actual -12 percent observed in June 2018.

At the pan-European level, consumer discretionary companies, which include automobile manufacturers, were among the worst performers in all three scenarios, alongside other cyclical sectors, such as materials, industrials and information technology – all crucial parts of the German economy. Defensive industries, such as utilities, real estate, and consumer staples, on the other hand, tended to be hit less hard.

Expected to Benefit

Safe sovereign bonds can be expected to benefit from flight-to-quality flows. Swiss confederate bonds showed the largest positive return on a duration-adjusted basis (normalized to an average duration of 7 years), outperforming their competitors from France, Germany, and the Netherlands. Peripheral issuers, on the other hand, are likely to suffer from increased risk premia.

Italy exhibited a particularly bad performance when using correlations from Q2 2018, as that was the onset of the budget conflict between its newly-formed populist government and the European Commission. But even under more recent conditions, Italian BTPs do still carry substantial spread risk.

In summary, in the event of a significant deterioration in the EU-U.S. relationship, Swiss investors may benefit from keeping their funds closer to home, as foreign stock holdings are likely to be hit by a double dose of falling share prices and depreciating exchange rates against the franc.

If, however, they have to remain invested in euros or dollars, high-quality sovereign bonds or, at least, defensive industries appear to be a more sensible alternative.

- For more information please visit Axioma

Christoph Schon, CFA, CIPM, is the Executive Director, Applied Research for EMEA at Axioma, where he generates insights into recent risk trends with a particular focus on fixed income and multi-asset class analysis. He has been in the portfolio risk and performance analysis space for over ten years, having previously worked for Lehman Brothers/Barclays Point and UBS Delta, where he held various roles as Marketer, Head of Client Services and Client-Facing Quant. He started his career in 2000 as a Fixed Income Research Analyst at Dresdner Bank in Frankfurt. He joined Dresdner’s FI index research group in 2002 and served as a member of the iBoxx European technical committee until 2006.