Streamline and Simplify Your Investment Process.

By Daniel J. Genoud, Client Relationship Management, State Street Switzerland

With increased complexity in all aspects of your operations, there is more pressure than ever before to work faster and smarter. State Street AlphaSM brings together the tools, resources, insights and partners you need at your fingertips on a single platform.

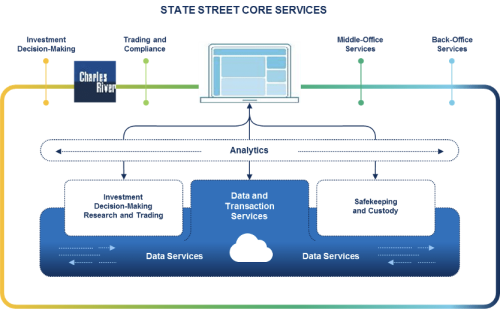

Shifting investor preferences, growing regulations and rapid industry consolidation are creating more complexity than ever. To manage the trade lifecycle, institutional investment and wealth managers need access to infrastructure that provides them with speed, efficiency and choice across their front, middle and back-office. From risk analytics and portfolio management to trading and settlement, AlphaSM can help you streamline and simplify your investment processes – all on one platform.

Alpha redefines the precept of «alpha» to mean powering better performance and outcomes at every point in the investment lifecycle. The platform supports your business across the entire investment process, automating workflows and streamlining operations, and giving institutional investment and wealth managers quick and deeper insights into portfolio construction. With data identified as lifeblood and a central component to the buy-side operating model, we made sure to incorporate system interoperability.

Having an effective data management strategy helps you uncover new insights, operate more efficiently and better serve your clients.

(Click on the image to enlarge)

Benefits of the Platform:

- Simplified data management – The consolidation of data sources and systems onto one platform eliminates manual reconciliation, increases data timeliness and accuracy, and encourages collaboration across your organization.

- Faster, more efficient investment decision-making – Frictionless access to the information you need helps you act on that data quickly. Our platform allows you to incorporate data from your own systems and preferred providers, making all of your information available across the investment lifecycle in near real-time.

- Increased focus on innovation – Less time spent managing data means more time spent on the business activities that make a difference to your investors: generating enhanced returns and developing new investment products.

Core Platform Capabilities

The Alpha Data Platform leverages Microsoft® Azure and Snowflake® to provide a centralized data management solution that aligns with your environment, delivers data in near real-time and integrates with third parties.

Institutional investors and wealth managers today are challenged by the depth and breadth of data available to them. They need new, innovative tools to manage and interpret this data at scale. We are committed to providing our clients with a data platform that meets these challenges within the investment management industry.

Our solution is a seamless environment for collecting, curating and validating the data that drives client investment processes. The model is fully open and interoperable, enabling the integration of your data and that of third-party services.

Having State Street as your partner provides you with market knowledge and global insights, region-specific local expertise, access to scalable and proven services, and rapid knowledge transfer, where necessary, for the development of best practices to scale your operations.

State Street is present in Switzerland since 1998. From our Finma-regulated custody bank in Zurich with close to 100 employees, we oversee a broad and diverse customer base comprising pension funds, insurance companies’ investment foundations, asset managers, fund management companies and public entities.

For more information please contact This email address is being protected from spambots. You need JavaScript enabled to view it. or +41 79 824 34 27.