Biodiversity refers to the variety of life on this planet at various levels, ranging from genes to species and ecosystems. For most of us living in cities or urban areas, wildlife can seem like an afterthought – something we watch on television.

What is biodiversity and why is it important?

However, the reality is we are all highly reliant on nature and biodiversity, as they provide us with many essentials we take for granted, like clean air and water, flood protection, and even carbon capture.

Yet today, we face an unprecedented loss in biodiversity, which undermines the stability of entire ecosystems and the services that we are dependent on. Over the last 50 years, we have been consuming the Earth’s resources at a faster rate than what can be replenished.

It is estimated that biodiversity loss alone reduces global GDP by 3 percent a year1 , and with over half of the world’s GDP dependent on nature and its services2, we need to act now to ensure our planet can continue to thrive.

How do you translate biodiversity into investment opportunities and harness them?

At J. Safra Sarasin Sustainable Asset Management, we have developed a framework that groups nature-related challenges into water ecosystems, soil and air. In our view, companies that tackle these challenges with innovative solutions can represent compelling investment opportunities.

Additionally, they benefit from a supportive environment, driven by three key trends. Firstly, rising awareness amongst consumers and corporates is fuelling demand for environmentally friendly products, such as electric vehicles, water efficiency, and renewable energies. Secondly, the falling costs of green solutions is a game-changer.

Over the past decade, the cost of renewable energies and other green technologies, like hydrogen and water treatment, have dropped significantly, becoming in many cases, on par with conventional technologies.

Finally, new regulations based on net-zero carbon targets or stimulus plans have never been more favorable for environmental solutions. The EU Green Deal, for example, will bring 470 billion euros of extra investments, spread over areas such as energy efficiency, the circular economy, and environmental protection.

How do you integrate biodiversity into your investment decisions?

Daniel: When analyzing investments, we consciously focus on companies offering solutions to address long-term transformational trends. As a result, we place special emphasis on certain key metrics related to natural capital in our investment analysis, for instance, recycling rates, water management, and pollution. These metrics are tracked over time to see if a company is improving its efforts to protect natural capital.

While we are aware that more granular data is required, some recent initiatives have been introduced to improve transparency. For instance, the Task Force on Nature-related Financial Disclosures aims to clarify the metrics surrounding biodiversity risks, and plan to test-run a reporting in 2022.

- Learn more about the JSS Sustainable Equity – Green Planet fund here

What is an example of a company that captures opportunities related to biodiversity?

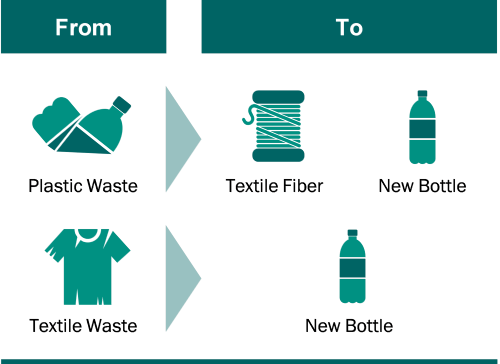

Daniel: Today, the world faces an enormous plastic waste problem, which negatively affects biodiversity, especially in the aquatic system. As a result, there is more regulatory pressure to reduce plastic waste. In the EU alone, the goal is to ensure that by 2025, 10 million tonnes of recycled plastics find their way into new products on the EU market. Companies are at the forefront of helping the EU to achieve this target by developing new and innovative solutions.

Carbios4 is a good example. It has developed a unique technology using an enzyme that breaks down the PET contained in plastic wastes and textiles, allowing them to be recycled into new products. Being a leader in delivering significant and scalable solutions to tackle the plastic issue, Carbios stands to benefit.

As an environmental pure player, its revenues contribute towards achieving the United Nations’ Sustainable Development Goal #12, «Responsible Consumption and Production». Our in-house analysis shows that Carbios is «best-in-class» from an ESG perspective. The company also uses an enzyme-based bio-recycling process, which requires lower temperatures compared to other technologies, thus reducing its energy use and intensity.

- Read more «Insights» from J. Safra Sarasin Sustainable Asset Management.

1European Environment Agency, Report on Biodiversity, 2015.

2World Economic Forum, «The New Nature Economy Report», Jan 2020.

3European Commission, Morgan Stanley, European Green Deal: The Opportunity (2020).

4The company presented is provided as an example investment and may or may not be part of the investment portfolio of the fund. The example is given for illustrative purposes only, does not constitute financial advice, and do not account for individual circumstances of potential investors.

This document does not constitute a request or offer, solicitation or recommendation to buy or sell investments or other specific financial instruments, products or services. It should not be considered as a substitute for individual advice and risk disclosure by a qualified financial, legal or tax advisor. Information containing forecasts are intended for information purposes only and are neither projections nor guarantees for future results and could differ significantly for various reasons from actual performance. In particular, neither the Bank nor its shareholders and employees shall be liable for the views contained in this document. The views and opinions contained in this document, along with the quoted figures, data and forecasts, may be subject to change without notice.