Switzerland is more attractive for fintech companies than London – this conclusion by a new study comes as a surprise.

London is the undisputed heart of the European fintech industry. It is where the most money is, the most jobs and the biggest market for its products. Financial-services companies such as UBS have located their brightest in the U.K. capital to develop their latest ideas. And the government has created jobs for the purpose alone to promote the local fintech community abroad.

Little surprise then that London and New York came up trumps in recent studies, which were also supported by the Swiss fintech industry. Switzerland by contrast was deemed to be average.

Fifth Place Globally

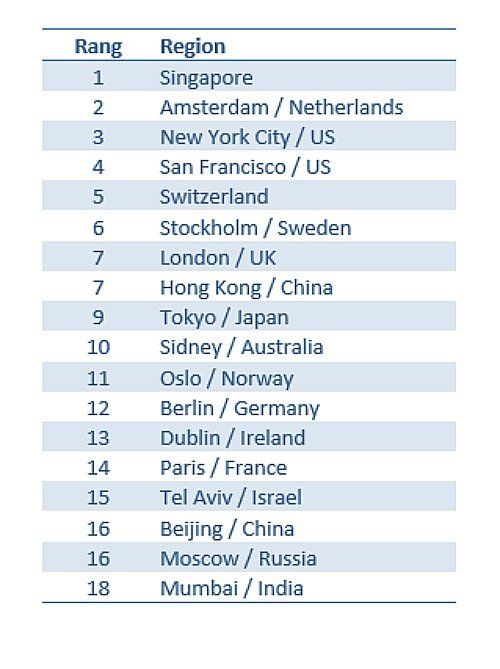

The latest findings however did not confirm this picture: The IFZ financial services institute based in Zug, Switzerland, published a report today saying that Switzerland offered a better ecosystem for fintech than London (see table below).

«In a comprehensive comparison of the general conditions Switzerland reached fifth position behind Singapore, Amsterdam, New York and San Francisco,» IFZ said. The institute offers its own digital banking course.

Detailed Approach

The researchers at IFZ knew their conclusion would come as a surprise to many and therefore described their approach in minute detail. The conditions have been divided up into sub-dimensions (politics, economy, society, technology, environment and legal system), which in turn were awarded different indicators.

Based on these conditions, IFZ compared the regions and concluded that the Swiss fintech environment convinced by the right balance.

Balance being a quality which is at the heart of the country's tradition of direct democracy and citizen participation. A value that however wasn't really called upon so far. Speed, state support and vocal marketing were values that stood out. In those respects, Switzerland was struggling, finews.ch concluded not long ago.

Brexit Looming

London by contrast is very strong on these counts. But with Brexit approaching, London will have to more than offset the risks inherent in leaving a large economic bloc and its strengths may not suffice.

The digital world of the fintech industry of course doesn't know any geographic or political boundaries. Their contact with investors, customers and regulators is online. Swiss promoters of fintech startups have therefore decided to concentrate on the internet and social media.