U.S. banks extended their grip on securities trading – not least at the expense of Swiss giants UBS and Credit Suisse.

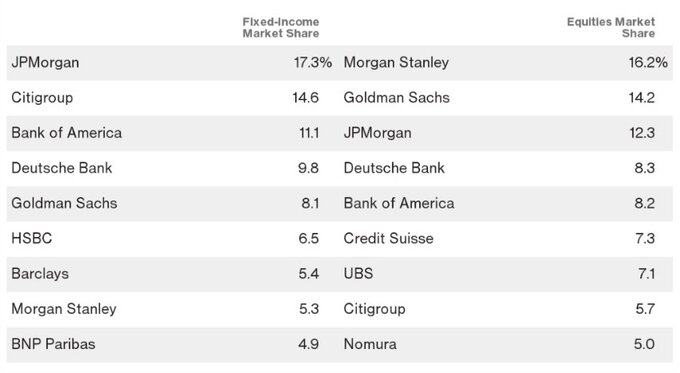

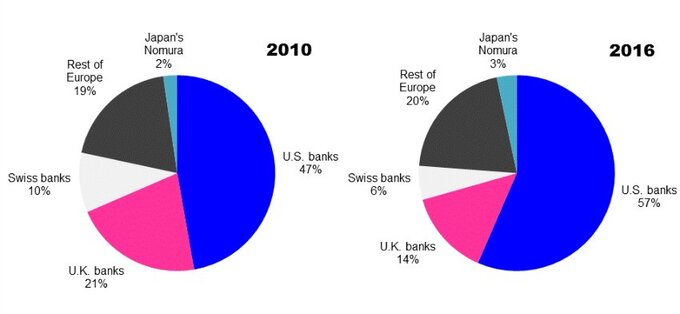

The big U.S. banks on Wall Street are in control of about 60 percent of the market share in global securities trading. UBS and Credit Suisse (CS) by contrast dropped out of the top ranks of fixed-income brokers, according to a report by «Bloomberg».

The development does reflect the strategy of the Swiss banks, which both are placing more emphasis on wealth management. Still, the two also want to retain full-service investment banks, despite having reigned in certain business segments – with the effect that they only play a marginal role by international comparison. Time will tell whether this strategy pays off.

The loss of market share in equity trading however must hurt CS CEO Tidjane Thiam, who promised to build up the Global Markets unit.

CS had the biggest drop in market share in the nine months through September 2016 since 2010 (the fourth quarter doesn't appear in the statistics yet), according to «Bloomberg».

J.P. Morgan, Morgan Stanley Take the Lead

J.P. Morgan by contrast expanded its dominant position in fixed-income trading since 2010. Morgan Stanley meanwhile has overtaken cross-town rival Goldman Sachs in equity trading.

The irony about these statistics is that the big U.S. firms were the ones who brought the financial system on its knees in 2008. Now, they are back on top, while the big European banks are falling behind.

The reason for the development: European banks did little to address the question about how much capital they needed to hold before the crisis of the euro. By that time, the U.S. banks already had restructured their businesses.

But the current leaders are well advised not to rest, Amrit Shahani told «Bloomberg». The expert at Coalition banking consultants said he expected Swiss and European banks to counterattack and recover some ground lost in the securities trading business.