Without being much noticed, events of recent weeks show that big European banks have turned the corner and left the legacies of the financial crisis behind them.

1. First Closure of a Bank

The act was one with symbolic character: Spain’s Santander took charge of Banco Popular for one euro after the European Central Bank had come to the conclusion that the company wasn’t viable any longer.

The procedure itself was taken straight out of the textbook: investors had to write off their assets as they had become worthless, while Santander assumed risk provisions of more than 7 billion euros, which it did by way of raising equity.

- Conclusion: Europe has shown that it can close a bank and that taxpayers don’t have to pay for it. The industry will be much stronger if this example is repeated.

2. Shift in Monetary Policy

As expected, the ECB didn’t raise its benchmark rate last week. But the central bankers adjusted their rhetoric and removed the wording about the possible rate increases from the forward guidance, the so-called easing bias. This doesn’t mean that it will raise rates tomorrow. But the days of a boundless bloating of the balance sheet and the quantitative loosening are over. First rate increases will likely follow in 2019.

- Conclusion: The signs of a shift in monetary policy are important for the banking industry.

3. Sustainable Growth

The previous point doesn’t come out of thin air. Europe’s economy is doing very well in some places, such as Spain and Ireland, and in stark contrast to the political chaos raging in other European countries. Spain and Ireland being countries that had been strongly affected in the aftermath of the financial crisis.

- Conclusion: Many of the (homemade) problems remain unsolved. But the economy in EU – even in Eastern Europe – has managed a respectable level of growth, which stimulated the banking industry.

4. It Takes More Than a Swallow to Make a Summer

Many banks have shown with their first-quarter results that they are still able to perform. Results were promising – one-time items, fines and extra-ordinary costs removed. Even the much-maligned Credit Suisse managed a first step toward a turnaround.

The government of the U.K. is no longer a shareholder of Lloyds Banking Group, another encouraging development. U.K. taxpayers had to fork out more than £20 billion to help Lloyds take over struggling rival HBOS. Now, the government even managed a profit of £894.

- Conclusion: Those developments are clear indications of a decisive shift toward the conclusion of the clean-up following the financial crisis.

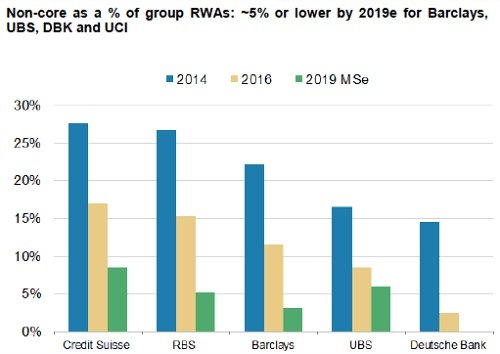

5. Elimination of Legacies

Numerous big banks have eliminated a large part of the legacies from the financial crisis, almost unnoticed, analysts at U.S. investment bank Morgan Stanley said in their recent study titled «Reflation, Restructuring & Regulation». In other words: What was almost beyond expectations given the incredible mountain of bad debt, seems to have come true (see table below).

- Conclusion: This helps the banks which achieved the feat, but provides a boost to the entire industry.

6. Regulatory Costs Have Reached Their Highpoint

The Morgan Stanley analysts also said that the ever-rising costs to meet tougher laws and regulation have reached their highpoint – see point No. 7.

- Conclusion: High regulatory costs have forced banks to avoid doing some of their business. This had a detrimental effect on earnings and profit which in turn prevented investors from buying banking stock. This may be about to change.

7. Reversal of Trend

In recent years, politicians and regulators excelled at demanding ever more stringent rules for the financial market. Now, signs are that a certain sense of moderation has set in. The first such indications came from the U.S. The U.S. administration is said to prefer two conservative candidates for vacant positions as directors on the Fed: Marvin Goodfriend, a university professor and Randal Quarles, a former member of the Treasury.

- Conclusion: Analysts expect the trend of ever tighter rules to have run its course. This is good news for banks in the U.S., and also in Europe.

8. Yesterday’s Losers Tomorrows Winners?

Lloyds Banking Group has shown the way (see point 4): there’s life after the crisis. UBS was another firm to proof that point. If you believe in this type of interpretation, yesterday’s losers will be tomorrow’s winners. Deutsche Bank? Credit Suisse?

- Conclusion: Investors should carefully evaluate the opportunities arising in the banking industry – if they don’t per se question the wisdom of large banking. The potential of Deutsche Bank for instance is enormous. One thing seems clear: Germany is the bastion of prosperity in Europe and will never allow its biggest lender to perish. Quite the contrary.