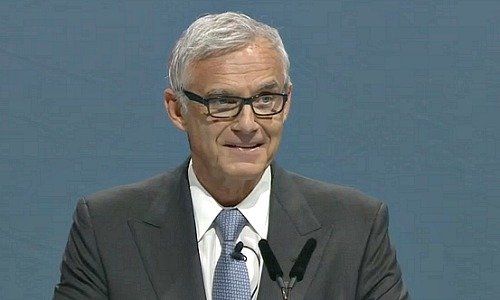

Credit Suisse shareholders backed the reelection of chairman Urs Rohner with a surprising level of support: the controversial Swiss lawyer had been at the center of a pay furor at the Swiss bank in recent weeks.

Urs Rohner, chairman of Credit Suisse, survived the annual rite of corporate passage, winning reelection to office from just over 90 percent of shareholders.

The overwhelming support for Rohner is surprising: the resilient former lawyer had sparked anger from both retail shareholders in Switzerland as well as of shareholder groups like Glass Lewis and Ethos Fund. Ultimately, Rohner and Chief Executive Tidjane Thiam were forced to back down from their original bonus plans to calm the waters, which it only partly did.

Last-Minute Apology

At first, Rohner made the issue worse rather than better. Swiss-based Ethos Fund called for him to step down, and Rohner acknowledged missteps in an apology to shareholders on Friday.

Just 10 percent of shareholders followed Ethos' recommendation to oppose Rohner. The 90 percent reelection rate is nevertheless a snub for the 58-year-old chairman – it is the weakest by far of all board members. Richard Thornburgh, a former CSFB investment banker whose reelection was also opposed by Glass Lewis, garnered 94 percent approval from shareholders.

Bonus Ire

Credit Suisse's controversial pay report eked out a 58 percent approval, which Rohner said he had noted as a signal from shareholders. An absolution of management and board conduct, unique to Swiss corporate law, passed with 88 percent of investors.

The results raise the question of whether the under-fire Rohner has successfully neutralized his opponents. He enjoys the approval of major shareholders including Qatar, Saudi Arabia's Olayan group, U.S. fund house Harris Associates, Norway, and U.S. asset manager Blackrock.

Tactical Move

Rohner likely sealed his approval with a host of last-minute, shareholder-friendly measures including promising a cash dividend instead of scrips, a higher payout ratio and already flagging a dividend intention for this year.

He even sweetened the bitter pill of a 4 billion Swiss franc cash call, offering the shares at a steep discount to current trading. Rohner, who has said he wants to preside the Credit Suisse board until 2021, appears to have headed off any opposition to his regency.