As long as the current reforms are implemented and not derailed, the financial system will in my opinion prove to be less risky than it was before: the Basel III reforms, for example, seem to be headed in the right direction. An increased requirement of equity capital, the introduction of a minimum liquidity ratio, the inception of macroprudential measures in the form of countercyclical equity capital buffers, a greater use of centralized exchanges instead of over-the-counter markets, institutional reforms all are genuine improvements.

That said, one cannot predict that there will be no future crisis. First, there are still major risk concerns. Second, and as I explain in the book, economists will always be more comfortable identifying the factors likely to lead to a crisis than predicting whether it will occur, or on what date. Just as a physician will be more comfortable identifying factors that might cause an illness or a heart attack than in saying exactly when they will occur.

Does the financial sector have a special weight in your research?

Yes I have always believed that the financial sector is key to a number of economic issues. Accordingly I have been working in this area for a long time: I worked on asset bubbles in my PhD thesis and shortly thereafter. Mathias Dewatripont and I published a book on banking regulation in 1994, when few economists were interested in this arcane topic.

Bengt Holmström and I also showed in the 90s how shortages of liquidity naturally arise in an economy and analyzed the role of the state in supplementing liquidity. Jean-Charles Rochet and I studied contagion effects and thought about the centralization of transactions in exchanges. The financial sector has become more mainstream in the 2000s and especially since the 2008 crisis. Like many colleagues, I keep working on banking and Sovereign crises.

Doesn’t your conviction policy stance run the risk of affecting the functioning of the free market economy by too many state regulations?

Economic regulation must strike a balance between inefficient laissez-faire and intrusive regulation that would hamper incentives, competitiveness and innovation. This is why I emphasize the need for taking into account the informational handicap faced by the state in many areas of economic regulation.

«Many of our key regulations have a microeconomic flavor»

As I show in my research, asymmetries of information have deep consequences for how one should design environmental regulation, labor market policies, innovation policies and many other regulations. Government hubris is dangerous as it may lead to the wrong policies.

What gave you the impetus to devote yourself to the topic of «industrial economics»?

Many of our key regulations have a microeconomic flavor. Industrial organization focuses on competition policy and the regulation of network industries (telecoms, electricity, railroads, postal services), but, to cite some other areas in which I have been working, banking, labor market and environment regulations are primarily microeconomic, even though they also have macroeconomic dimensions.

What are your research activities today?

With co-authors, as research is so often teamwork, I am working on a range of topics. Industrial organization of course; banking, including how shadow banking poses new challenges and alters our regulatory and macroeconomic environment.

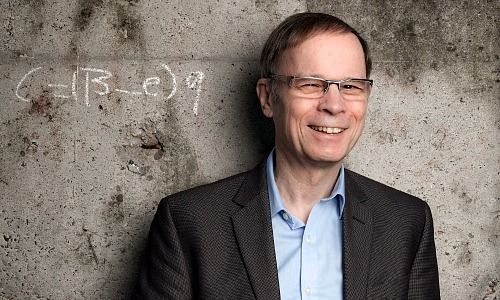

- Jean Tirole is the Keynote Speaker at the 12th Annual Meeting of the Swiss Finance Institute on the 4th of October 2017 in Zurich.

Jean Tirole is laureate of numerous international distinctions, including the 2014 Sveriges Riksbank prize in economic sciences in memory of Alfred Nobel and the 2007 CNRS gold medal. He is chairman of the Jean-Jacques Laffont - Toulouse School of Economics Foundation and scientific director of the Institute for Industrial Economics. He is also affiliated with MIT, where he holds a visiting position, the Ecole des Hautes Etudes en Sciences Sociales, the Institut de France and the Institute for Advanced Study in Toulouse, which he co-founded in 2011. He has published over two hundred articles in international reviews, as well as twelve scientific books. Published in French in 2016, his latest book entitled «Economics for the Common Good», accessible to a wide audience is under translation into a number of other languages.

Previous contributions: Rudi Bogni, Peter Kurer, Oliver Berger, Rolf Banz, Dieter Ruloff, Samuel Gerber, Werner Vogt, Walter Wittmann, Alfred Mettler, Peter Hody, Robert Holzach, Craig Murray, David Zollinger, Arthur Bolliger, Beat Kappeler, Chris Rowe, Stefan Gerlach, Marc Lussy, Nuno Fernandes, Beat Wittmann, Richard Egger, Maurice Pedergnana, Marco Bargel, Steve Hanke, Andreas Britt, Urs Schoettli, Ursula Finsterwald, Stefan Kreuzkamp, Oliver Bussmann, Michael Benz, Peter Hody, Albert Steck, Andreas Britt, Martin Dahinden, Thomas Fedier, Alfred Mettler, Brigitte Strebel, Peter Hody, Mirjam Staub-Bisang, Adriano B. Lucatelli, Nicolas Roth, Thorsten Polleit, Kim Iskyan, Stephen Dover, Denise Kenyon-Rouvinez, Christian Dreyer, Peter Kurer, Kinan Khadam-Al-Jame, Robert Hemmi, Claude Baumann, Anton Affentranger, Yves Mirabaud, Katharina Bart, Frédéric Papp, Hans-Martin Kraus, Gerard Guerdat, Didier Saint-Georges, Mario Bassi, Stephen Thariyan, Dan Steinbock, Rino Borini, Bert Flossbach, Michael Hasenstab, Guido Schilling, Werner E. Rutsch, Dorte Bech Vizard, Adriano Lucatelli, Katharina Bart and Maya Bhandari.

- << Back

- Page 3 of 3