More than half of all wealthy Swiss will change their bank of choice over the coming three years. But they’re not planning to take their business to neo-banks and fintechs.

The Swiss traditionally are known as loyal clients, which is why neo-banks and fintechs have found it rather more challenging to gain ground in Switzerland compared with other European markets. Now though the traditional institutes catering to the needs of the wealthy are in for choppy waters, says EY consultancy in a study.

A total of 51 percent of the wealthy Swiss clients are planning to change their bank in the coming three-year period, said the authors of the study, Urs Palmieri and Bruno Patusi. The most frequently cited reason for such a change is an inheritance, which often significantly improves the level of wealth.

A Swiss Exit

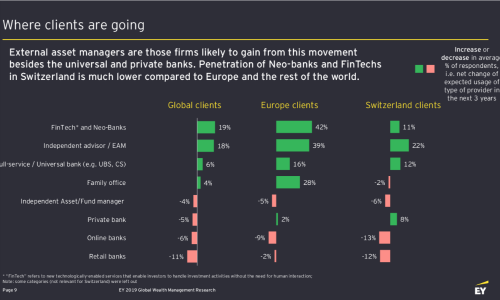

The Swiss banks which cater for domestic clients are facing a much more dramatic wave of exits than foreign rivals. While the share of clients looking for a change is stable abroad, the opposite is true for Switzerland (see table below).

Still, the domestic industry can pride itself with having instilled a strong sense of brand loyalty with Swiss consumers. Clients in Switzerland appreciate the value of the brand and credit worthiness, but also performance of the wealth management business, the authors said in the study. Half of all clients also acknowledge the global reach of the Swiss companies and the variety of products on offer.

Boom Time for Independents

It isn’t the startups and neo-banks such as N26 that are in for a surge in demand, but independent wealth managers and the big banks. While independent wealth managers have long been deemed a dying breed, the EY consultants reach the opposite conclusion – it is boom time for the independents.

But the firms that stand to profit from the change ought not to rest on their laurels. The banking experts at EY say that many Swiss clients don’t know how the fees add up. Two thirds of all the wealthy clients are unhappy about fees and judge them to be unfair. If the wealth managers don’t turn this round and learn to explain their charges, many potential clients may yet turn their backs on them.