6. It's Switzerland, Stupid

For Credit Suisse, the Swiss business represents the most compelling argument to bank «new» corporate clients. The bank lifted the Swiss unit's pre-tax profit by 18 percent on the year to 654 million Swiss francs ($660 million). Its return on regulatory capital hit 20 percent.

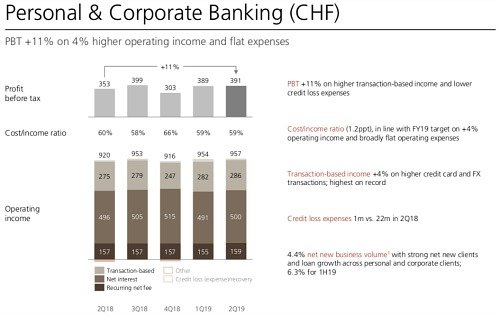

UBS made inroads, but modest ones. A glance back several quarters demonstrates it is stagnating at a relatively high level (see graph below). As market leader, UBS simply doesn't have the same room to grow, but a little more oomph to innovate as finews.com wrote earlier this week wouldn't hurt.

7. CEOs in Hot Seat

Show us a CEO who has experienced as dramatic a reversal of public opinion as Credit Suisse's Tidjane Thiam: the banker was showered with praise in 2015 when he arrived, only to lose the goodwill following a series of indiscretions, spats with his Wall Streeters, indiscretions, and other hostilities. This didn't stop the 57-year-old French-Ivorian former consultant from powering his three-year restructuring through (concluded last year). Of late, he has sought to polish his image with comments alluding to a desire to stay in Switzerland and take on citizenship (he will be eligible to do so in 2025).

At UBS Sergio Ermotti's carefully-cultivated elder statesman persona has taken a beating: the Swiss bank has suffered several notable exits in the last 18 months, his share price has languished, and he has suffered setbacks in a years-long French case. The 59-year-old Swiss banker cannot shake the impression that he is too mired in problems to think about how to return UBS to growth.

8. Ongoing Cost Pruning

Both banks have undertaken rigorous spending cuts so that they are somewhat better positioned than bulkier European rivals (cue Deutsche Bank). The German lender's 18,000 jobs cull illustrates that Swiss companies have generally been much more vigilant – which has served them well as digitization's influence is increasingly felt.

But cost costs alone, of course, aren't a strategy for success. While Thiam's Credit Suisse can shift into more of a daily business fashion following three years or cuts and internal unrest, Ermotti says he is heading back to the drawing board to look for more fat to trim. He is thinking of an evolution, not a revolution– he should probably think bigger.

- << Back

- Page 2 of 2