Both big Swiss banks surprised investors: UBS with a good quarter and Credit Suisse with a strong first six months of 2019. Despite their similarities, the differences between the two wealth managers are growing.

1. Fresh Money

A glance at second-quarter growth shows that Credit Suisse leads its bigger Swiss rival in wealth management; meanwhile, the two are neck and neck in Switzerland, with UBS at 2 percent growth and Credit Suisse at 2.3 percent. The picture is much more dramatic is Asia: Credit Suisse is hoovering up 5.1 percent on its existing assets, UBS a dull 1.1 percent.

To be sure, their respective wealth divisions are set up differently: UBS' global division (which overall managed 3.5 percent net new money growth) encompasses an elaborate and highly profitable U.S. business, while Credit Suisse's international wealth management (a 6.2 percent rise) strips out Asia and only includes a marginal U.S. business.

2. Fat Margins

Credit Suisse is squeezing more out of the funds it manages for wealthy clients: its Swiss business and international wealth division recorded a net margin of 60 basis points and 41 basis points, respectively. In Asia, Credit Suisse's wealth arm outstripped that of UBS' global arm on margins, at 27 basis points vs 14.

The difference may lie with a far greater portion of net interest income at Credit Suisse, which made for 42.5 percent of revenue at its wealth arm. By contrast, it culled less than one-third from recurring fees. At UBS, the recurring income makes up more than half of the unit total, while interest is a puny 12.5 percent. In other words: Credit Suisse probably lends more generously – and likely more riskily – than its larger Swiss rival.

It is safe to assume that this type of revenue is at risk if an economic downturn forces Credit Suisse's wealthy clients to tighten their belts. The revenue that UBS leans heavily on is by definition more stable. Until the next market crash, UBS will have to live with getting beaten by Credit Suisse on profitability.

3. Return on Capital

Credit Suisse's return on equity of 10 percent raised eyebrows on Wednesday: investors applauded the bank's hitting a key target. At 12 percent, UBS is better off, but Credit Suisse is making inroads.

4. Growth Plans

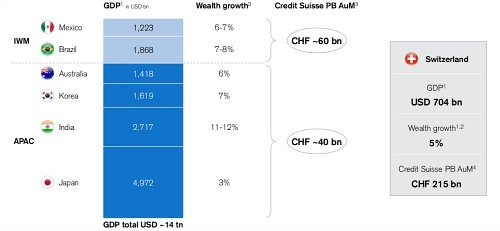

By contrast, UBS has honed its focus on China. Whether U.S.-Chinese trade tensions and unrest in Hong Kong threaten this strategy remains to be seen. UBS is also targeting the world's super-wealthy, including by ramping up in America. But the super-rich segment has seen outflows in the U.S. in recent months. The bank hopes to kickstart overall money growth with initiatives like a recently-inked tie-up with Japan's Sumitomo.

5. Trouble Spots

Both Swiss banks have effectively demoted their investment banks to service centers for their private banks. But Credit Suisse can illustrate this better than UBS, which has had a few units at the securities unit in recent months. At Credit Suisse, a global markets unit finally managed a commendable result after several troubling quarters.

All told, Credit Suisse appears a more credible «entrepreneur's bank» which can link up wealth management and investment banking. Meanwhile at UBS, co-heads Piero Novelli and Robert Karofsky are still busy moving parts around following the departure of star dealmaker Andrea Orcel last fall.

- Page 1 of 2

- Next >>